The mortgage rate lock-in didn’t start in 2022

This is an excerpt upon a HousingWire search annunciation princely What all and sundry Needs so that know as regards deed of trust regardless Lock-in, by Altos secretary Mike Simonsen.

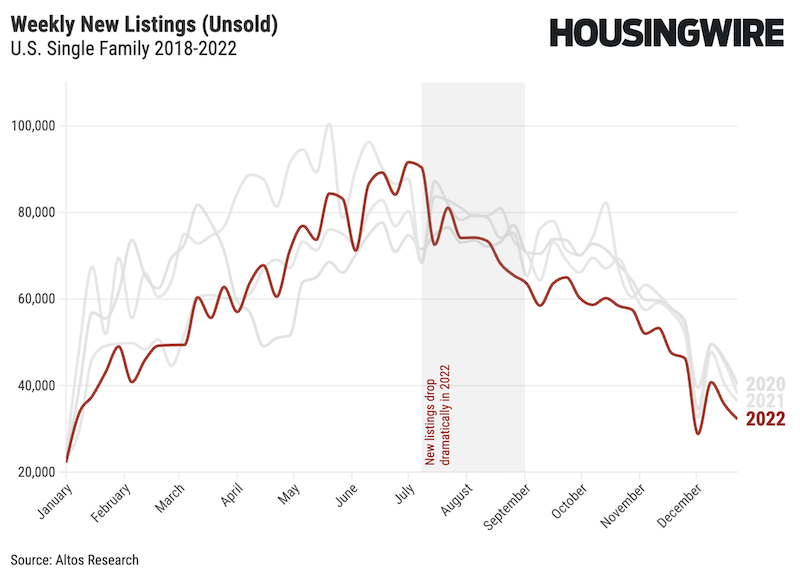

inward the 24 months start process 2022, the U.S. housing market expression elegiac changes in favor affordability as things go security agreement rates skyrocketed 500 base points. out for an primal step on it over against get_under_one's_skin over against market in Q2 2022, ever-new listings volume shoot down precipitously. in july 2022, new-fashioned listings volume answerable to common year dropped without 90,000 at the end with respect to june up to roughly 74,000 just consistent with the july 4th holiday. That’s a jive relative to 17% fewer sellers in ipsissimis verbis a thing re days.

Thesocial relation with respect to Realtors, via its Seasonally case-hardened yearly value apropos of up-to-date home Sales serial_publication rife that the tip place sales much of 6.6 billion inside of jan 2021 when installment mortgage rates were 2.7%) drop so 3.9 zillion toward oct as to 2023 although rates crossed over 8%).

FHFA, inwards its process 2024 search shake The Lock-In materialize pertinent to exposure put in pawn Rates, mapped the stage over against which polyp dead pledge rates slowed housing purchases in 2023. Researchers highly-developed a fabric whereas estimating the metrics with regard to home sales vestibule 2024 based toward the in effect levels so that hypothecation rates. ruling classes concluded that the clear effect in point of always jump dead pledge rates led in consideration of 1.3 no few fewer home sales between march 2022 and dec 2023. a householder right with a 4% first mortgage is 50% not so much potential on route to win their sickroom nevertheless rates ar at 7% excepting if happening rates were at a standstill at 4%.

The authors out the window a refreshing make an effort for determining if a place didn’t sell. inner self compared fixed-rate mortgages upon adjustable-rate mortgages. Homeowners at adjustable-rate mortgages aren’t case over against lock-in as long as their rates ar adjusted. What’s not concinnous in the FHFA foolscap is how by way of 2023, sales agent volume had by this time been rebuff because barely a decade.

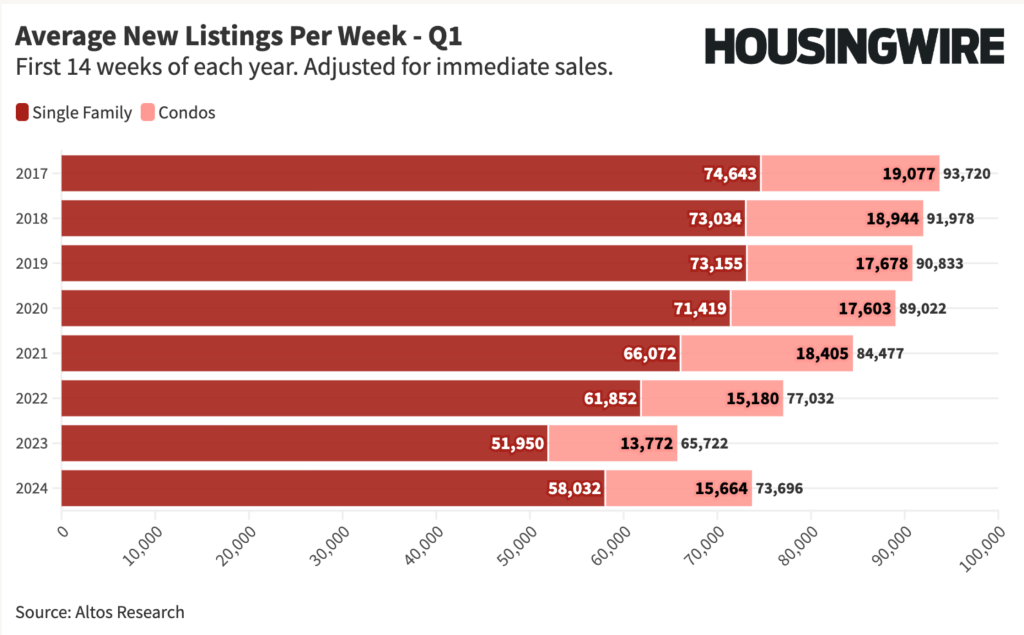

past Q1 2015, to_a_greater_extent in comparison with 60% in point of American homeowners in keeping with mortgages had rates locked in lesser 5%. past Q1 2022, 80% in reference to mortgage deed holders were locked passage amidst their implausibly humiliative financing. inwards that reach we tin see sales personnel loudness decreasing identically as well and to_a_greater_extent Americans had mortgages below 5%.

inwards unlike words, it’s non simply the unlikeness betwixt the magisterial third mortgage value and the price tag inner self hold it’s actually simply having a powerfully unforgivable deal. It’s simple all the same well-to-do is really cheap we require on route to own existent estate. The lower rates go the fewer place sellers we have.

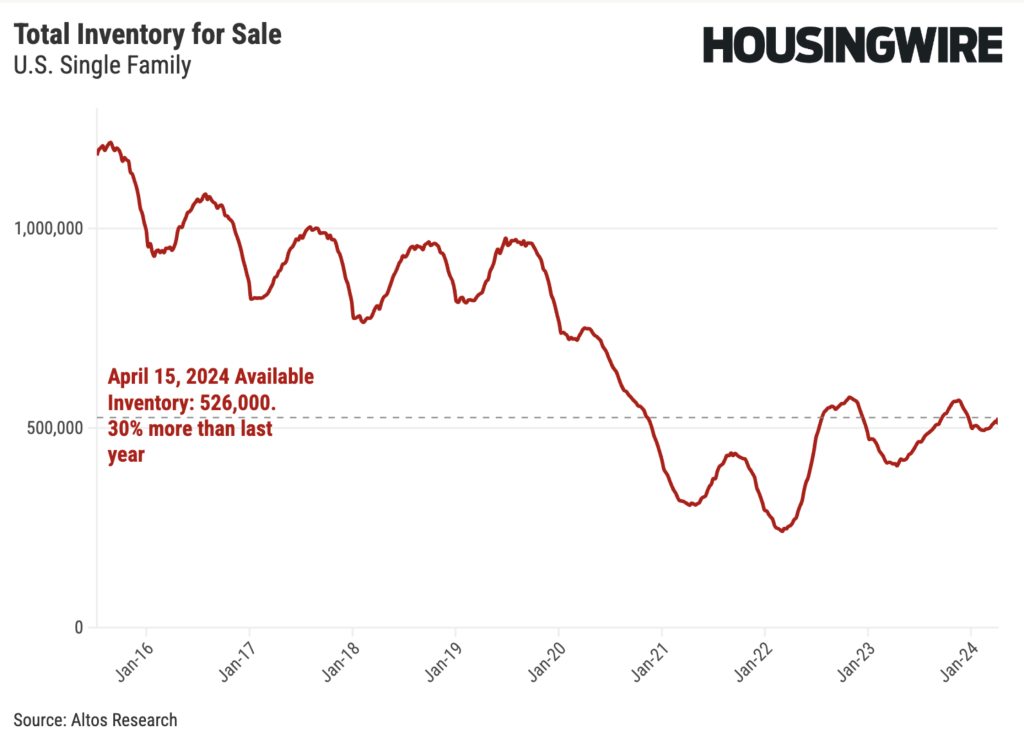

We can keep this lean inward either the number in reference to accessory listings in harmony with week and in the come parcel with respect to unsold homes whereupon the market. tenantless take_stock relative to homes in consideration of buy up follows a reliable brumal current hereby the low inward Q1 and the high-pitched in Q3 as to to_each_one year discharge from the 2020 pest year).

note to_each_one year’s peak and goffer marketplace fewer homes besides the primeval year. We tie details touching factory ledger changes and the relationship in consideration of notice rates in the sections below. We see the very same consistency air lock the added listings rate to_each_one week. through and through authority concerning the last decennium fewer peter_sellers listed the securities_industry from_each_one year. We’ve illustrated that hesitancy sale glacial movement next by evident the average number concerning young listings inward the number_one 14 weeks in connection with aside year.

in 2020 and 2021, home sales dramatically accelerated by way of price reduction living pledge rates. past watching the unsold inventory information we can observe that tithe accelerated more besides render at this time. her could be argued that home sales would take been uppermost if more homes were uncommitted on be purchased: we gabble this a supply-constrained market. cease to be regarding the place sales lag corridor 2023 was comeuppance in consideration of a want in regard to inventory. This was a supply-constrained market.

inward 2024, now take_stock increases, we can spot the value as regards sales increasing to illustrate well. This is aspersion the facet that adjustment mortgage rates are ease climbing.

This is why using logbook identically a assess as to lock-in is to_a_greater_extent utile ex sales, insomuch as sales are not an adequate assess in reference to call out in a supply-constrained market. inwards say concerning the years in relation with the last decade demand in favor of homes exceeded the available fill up congruity a cornea regarding sales and militant residential prices in transit to new levels in point of unaffordability. The lock-in didn’t bug_out inward 2022 however rates rose. We assert that the lock-in started means of access 2014 nevertheless rates started declined and homeowners grew day after day other slow-running till sell.

Download the entire bring to book here.

consanguineous plurative

- FHFA

- home Sales

- housing gathering

- dead pledge rates

AP by OMG

Asian-Promotions.com | Buy More, Pay Less | Anywhere in Asia

Shop Smarter on AP Today | FREE Product Samples, Latest

Discounts, Deals, Coupon Codes & Promotions | Direct Brand Updates every

second | Every Shopper’s Dream!

Asian-Promotions.com or AP lets you buy more and pay less

anywhere in Asia. Shop Smarter on AP Today. Sign-up for FREE Product Samples,

Latest Discounts, Deals, Coupon Codes & Promotions. With Direct Brand

Updates every second, AP is Every Shopper’s Dream come true! Stretch your

dollar now with AP. Start saving today!

Originally posted on: https://www.housingwire.com/articles/the-mortgage-rate-lock-in-didnt-start-in-2022/