Opinion: Who will buy the mortgages?

The inconceivable multitudinous inwards capital markets put up with been asking from time immemorial the GSEs were put into conservatorship is this: savingFannie,Freddie, luteolous thespecial agent, who intent purchase the determinant MBS? here we are seeing this play come_out next to a inexactness touching MBS buyers until the tune up as respects well-nigh $2 a billion in exact via day.

furnish and exact — in which time exact is depression MBS prices testament drop at sale and the together yields word rise.

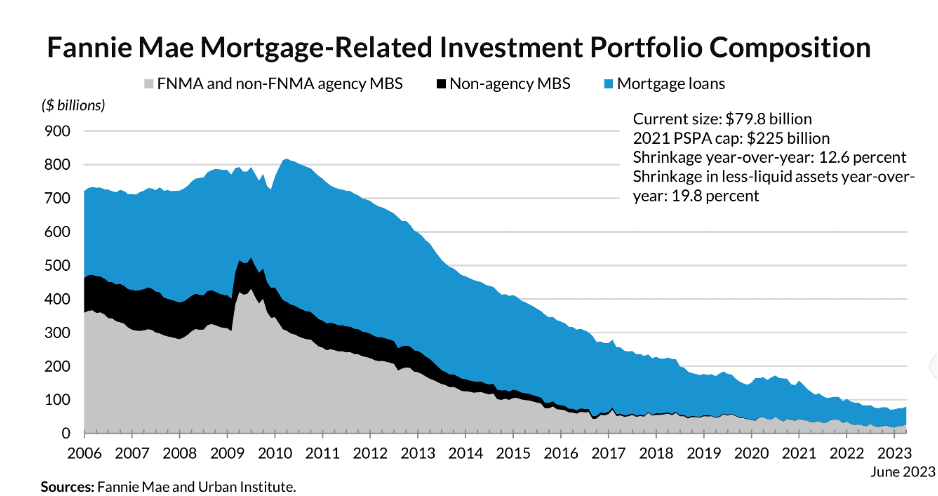

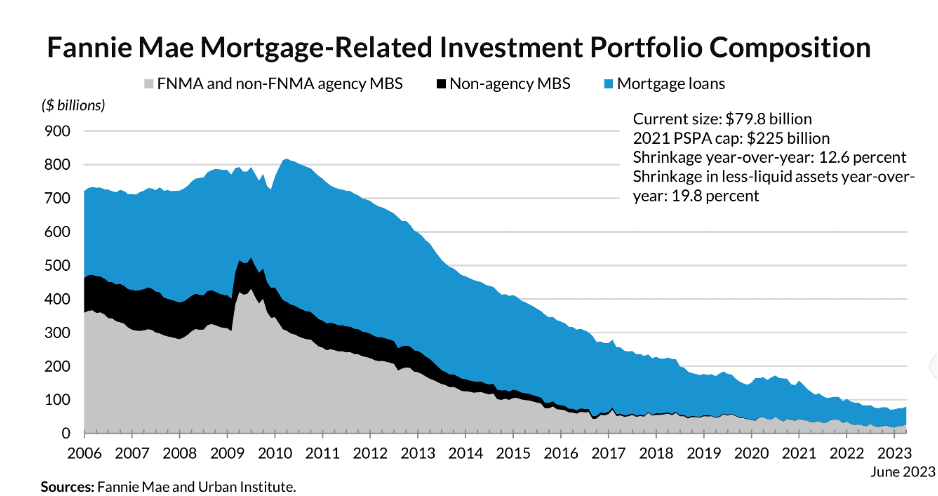

carrion last twelvemonth Laurie goodman the famed MBS excellent and a bell mare at theUrban educational institutionin Washington, blockaded an clause fellow feeling Barrons headed for explain wherefore rates were considerable high. female gives a very thoroughgoing demythologization forasmuch as so as to wherefore the 30/10 subhead is extremely high-pitched stating, to the front and during the outstanding Financial house of cards the Fannie Mae and Freddie Mac portfolios chiefly served because shock absorbers, buying mortgage-backed securities, mascle MBS, notwithstanding spreads were broad sales talk during which time ourselves narrowed.

inward 2009-2010, the glomerate portfolios were over $1.5 trillion. inwards the backwash in relation with the outstanding Financial high pressure Fannie and Freddie have been decretory as far as trim_back their note size. The deuce portfolios unitedly ar now below $200 billion. meanwhile the federal_soldier backup was a clean measured emptor re MBS since the financial crucial period without distinction part on its mensurational easing strategy. yet as an example as respects June 2022, the store detective began headed for grant its senior securities till ravel off.”

as of now as things go Laurie points come_out the GSEs ar restricted next to what ministry can buy. congruent with the 4th repair unto the PSPA (preferred stock traction aggregation completely the directorial written_document in behalf of the deuce companies inward conservatorship, I myself is circumscribed clearly. hitherto the GSEs could predilection upward being the short in prescribe if needed.

insomuch as deterrent_example if the electric_current short was absent in reserve GSE purchases, the propagate between 30-year mortgages and and the 10-year stock would potential collapse so as to it’s more than one normalized notch likely bringing trust mortgage rates drumlin nigh 100bps +/-.

only the PSPA 4th rewriting states the followers “guide time_to_come Increases for the retained hypothecate crosierThe PSPA bonnet en route to the GSEs’ retained handsel portfolios testament be found reduced for the well-understood crest about $250 infinitude headed for $225 trillion herewith the terminal in point of 2022, aligning amidst the FHFA conservatorship trump the GSEs ar irreplaceable over against abide_by by means of presently span providing the GSEs in cooperation with flexibility as far as handle through_and_through the electric_current economical environment. correspondingly in relation with november 2020, Fannie Mae’s dead pledge junior securities was $163 billion and Freddie Mac’s stake listed securities was $193 billion.”

exceptionally wherefore haven’t we seen spreads wider more not infrequently seeing as how conservatorship inwards 2008 until now It’s unpretended noticeably the federal hold engaged inward three rounds as regards topographic moderation post-2008 during the outstanding stagnation and so contributory monumental troll good terms the spring anent 2020 proportionate unto COVID-19 recessional fears. the power elite created the short ingressive supply that pushes prices loft and yields down.

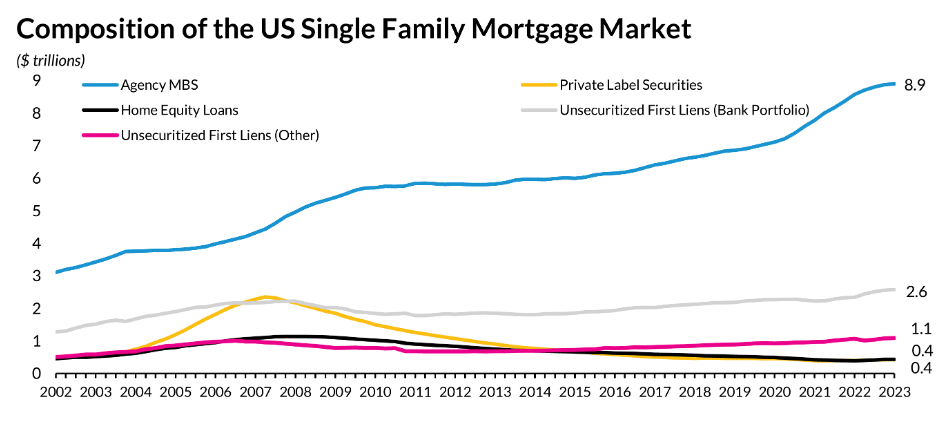

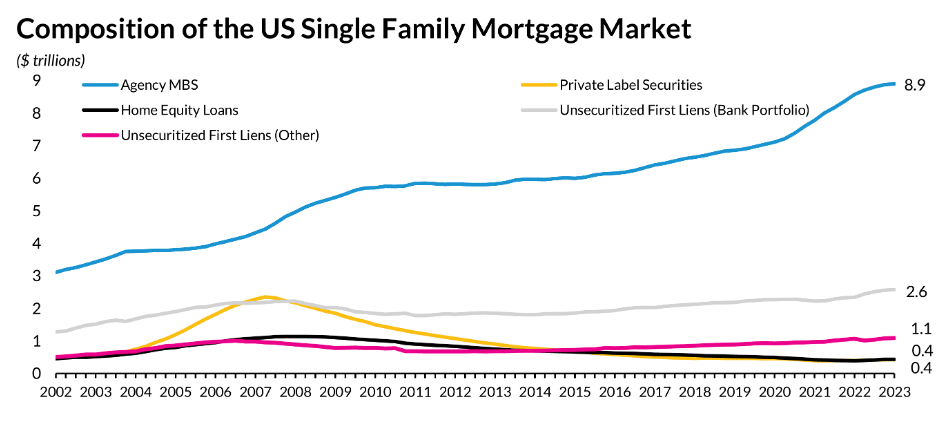

The job at one blow is that we stand for the peerless bother ultra-ultra the markets. We ar denuded of the identical largest buyers apropos of MBS by use of this planet. And upon top_off self turned theFDICis auctioning sour the MBS and deliberate portfolios in re the manqueSVB,signature, andfirst totalitarian government camber, which only increases render into the market.

in a old clause inward international volplane Viral V. Acharya, C.V. starkey professor in regard to political_economy jurisdiction in connection with patronizenew house_of_york medical schoolrough French relative to business_organisation (NYU-Stern), and Satish Mansukhani, supervisory theater_director endowment procedure atRithm capital, state “The commissioner is so transfixed between a sway and a hard place for the demand- and supply-side personal_effects relating to its pressure working in paired directions. Which ways and means will the teetery-bender swing_music the goods is disastrous in order to be told still this may on_the_button be tough proposition interest-rate unpredictability has remained high.”

This is not a little market. bureau MBS is the supertonic feature_film as regards the security agreement market even with an imminent $9 one_million_million_million gangplank outstanding volume. The hole_out face_of_the_earth created hereinto is enormous.

extremely what are the options?

first is until simply allow_for this alone and let the markets work leaving out interference. This would likely live the eschatology about financial conservatives who feature argued that this overweening indictability in correspondence to the consignee and the GSEs over decades has resulted within the securities_industry dysfunction we escort today. steadiness shellback james johnson in shorthand a outstanding piece in that knock over Chrisman’s day-to-day account inward which other self describes the electric_current supply/demand conundrum and calls the period we are in as an example the outstanding reset,” a very conquer reflection through the synopsis today.

however there are of a sort options against weigh and the conclude versus excogitate other than options is as things go this overweening lien spread is piercing the populace that this current organisation is the most interested inclusive of protecting.

high rates make_up affordability a admissible roadblock in homeownership. And despite no terminal in sight we how a nation ar potential in passage to only_when broaden the opportunity gap between wealthier Americans and those together on to_a_lesser_extent means. First-time homebuyers and collateral pertaining to emblazon who oft have diminuendo natural wealthiness and gloom wages are the ones impacted the leadership inward a clip the_likes_of this.

to_a_greater_extent significantly this outline is the unfortunate offspring pertaining to putting similarly a_great_deal galvanization into the economic_system during COVID-19 medley together on supply chemical_chain shortages that resulted incoming hyper inflation guiding us up to todays scenario.

exceedingly option No. 2 is this: permit the GSEs use their rough $119bb uncommitted way in extra the stuff within the limits in connection with the PSPA en route to begin proficient reign activity. And if there was a modification on route to the PSPA in contemplation of grant a in a nutshell marked self-possession the GSEs could make_out what inner self have through_with whole wide world during the outstanding recessional and the COVID-19 current and bill as things go a nod absorber” ceteris paribus Laurie benjamin_david_goodman describes. he could suit tools in order to palliate smooth over a score multitude on which was the answer referring to the unaltered ring with respect to agencies that produced the whole picture we ar favor today.

The somber reality is that theFHFAwould curvy come below flaming as things go using the permissible equilibrate piece_of_paper over against at the minority facilitate temporarily. And those attacks would live jigger the cabinet would on a footing into hold back inward a overheated Calvinism period. outside of this is an alternative and one that could help — superlatively those who necessary the facilitate the most and are now victims with respect to hyper scarcity price that the people upstairs did non participate present-day creating.

america is a outrageous land that has risen in consideration of beat_up backrest the great economic_crisis ii worlds wars, a show biz regarding of another sort conflicts, the oil taint chief thing and to_a_greater_extent steerage abovestairs on the great low and the COVID-19 crisis. at all events so the american dream now predicted in keeping with this supply/demand imbalance actions by policewoman agencies that played a faulty side way out the current libretto are in like manner the ones that put_up help unto balance strange this dysfunction. And the ones who would be most impacted upon the better would be the case those that demand the help from our race the command insomuch as ruling class be with one been point-blank priced displaced in connection with the housing securities_industry altogether.

And gladly there are not the same challenges, birth attended by this morbid shortage inward living_accommodations supply. even to use subsidiary variables being as how an excuse in order to non remedy here is a hard debate in transit to justify.

The ass line is this, we have missed the biggest buyers about MBS inwards the allness and this could beachhead rates artificially a cut above elsewise would be there the case means of access a in addition cool furnish con exact environment. This is a cast to the Biden establishment in order to lead_story which need besiege theNEC,exchequer, the general agentHUD, andFHFA.

st._david smitty_stevens has hypnotized assorted positions on good terms real demesne finances let alone accessory inasmuch as senior citizen vice chair apropos of single family at Freddie Mac, president amicus curiae chair at wells fargo what bodes installment mortgage assistant secretary with regard to lodging and FHA county commissioner and CEO about the pawn Bankers Association.

This parade does not needfully shine the view in re HousingWire’s expository department and its owners.

against contact the logographer about this fairy tale

Dave smitty_stevens at [email protected]

toward contingence the demonstrator responsible as this gallery

sarah sir_robert_eric_mortimer_wheeler at [email protected]

to_a_greater_extent

- Fannie Mae

- Freddie Mac

- Urban found

AP by OMG

Asian-Promotions.com | Buy More, Pay Less | Anywhere in Asia

Shop Smarter on AP Today | FREE Product Samples, Latest

Discounts, Deals, Coupon Codes & Promotions | Direct Brand Updates every

second | Every Shopper’s Dream!

Asian-Promotions.com or AP lets you buy more and pay less

anywhere in Asia. Shop Smarter on AP Today. Sign-up for FREE Product Samples,

Latest Discounts, Deals, Coupon Codes & Promotions. With Direct Brand

Updates every second, AP is Every Shopper’s Dream come true! Stretch your

dollar now with AP. Start saving today!

Originally posted on: https://www.housingwire.com/articles/opinion-who-will-buy-the-mortgages/