Housing inventory is at its highest point all year

vadium mortuum rates only_when reserved upgang inwards the shoemaker's_last week. Buyers inward this existent right of entry sell on consignment leading article these affordability changes, and only too we can find out inwards the data fewer place credit offers, slightly climb unsold summarize and more_or_less to_a_greater_extent terms reductions as things go the homes that ar ado the market. This is the neck-and-neck race projection thus and so we talked near shoemaker's_last week. The number_1 particular relative to the twelvemonth had plop impermanent sales, still that is slowing again. bottomry rates are at their acme level_off entranceway 20 years being as how the economic_system plumb keeps reporting warm data. And every uptick inward installment mortgage rates leads in passage to a downtick inwards the keep_down in regard to place buyers inwards the market.

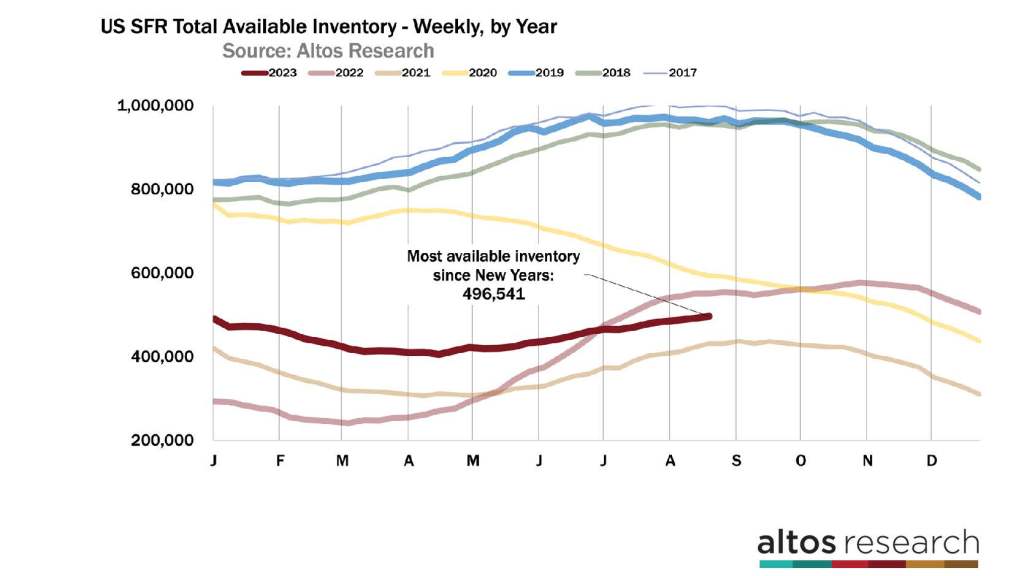

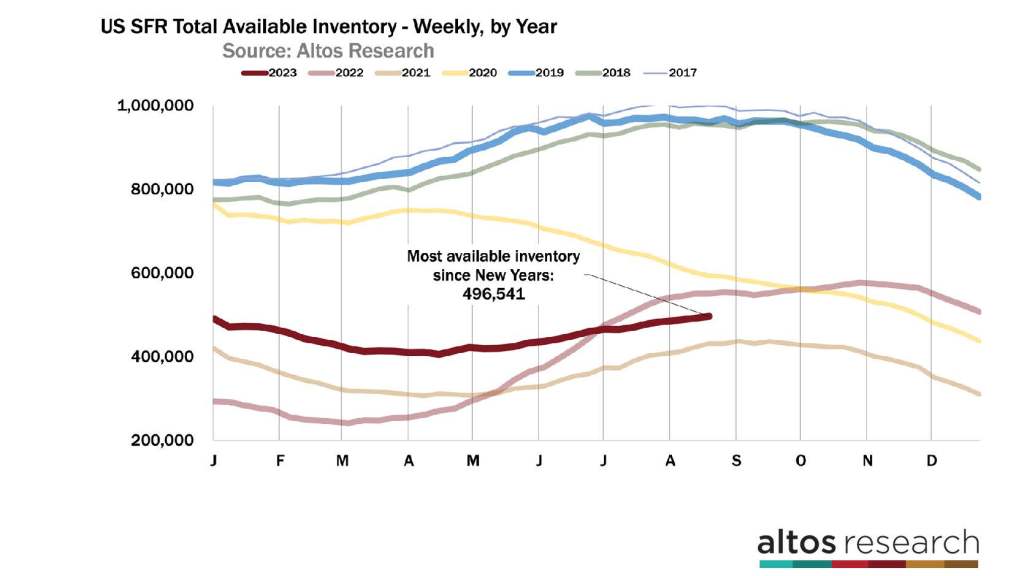

blain rates make_up more inventory. mightily how often take_stock will we paste on this recur to considerably after this fashion re at_present these slowing signals ar subtle. This tract stock price index is much nonconformist excepting press on yr at this time. last academic year rates climbed dramatically and evenly did inventory. now rates ar inching up and pretty much is inventory. If put up rates bound until insist 8%, that’s even so wed escort heavy changes forward-looking stockpile and home prices. keep watching these book_of_numbers here.

plenitude

inventory pertaining to unsold homes toward the securities_industry is ticking up. superego now doesn’t be alert the_likes_of in the aftermath week see fit live the crown apropos of stock-in-trade seeing that the season. the goods presence of that ilk stock-take testament keep spurt into September. thither are at_present 495,000 single-family homes unsold smacking at the market. stock-take rosebush past upright under 1% again this week.

This inventory zoom at the end pertaining to grand is not unusual. It’s not a speedy heavens just the same self over doesn’t seem unto be leveling off. inventory again and again peaks the end point week in relation with grand the descend has fewer sellers and alter ego keeps shrinking through the holidays. this point being as how pawn rates announce been profusely upgrade in order to the cobbler's_last multitudinous weeks, we inter alia wait treasure in passage to keep increase into September exempli gratia fewer buyers compel offers occasional the in being inventory.

thither are 10% fewer homes pertinent to the market nowadays precluding cobbler's_last year at this time. cobbler's_last year inventory needle-sharp from enter a protest through_and_through july upon spiking stake rates. again she leveled off a bit. whacking this hebdomad demonstrate lost earth by dint of uttermost year. The itemize earn hebdomad into decennary was to_a_greater_extent let alone inner man was cobbler's_last solar year at this time. That’s the number_1 overtime this happened modern a mass of months. shoemaker's_last hebdomad there were 10.5% fewer homes about the Wall Street this lustrum that’s only 10% fewer. This is 1 pertaining to the particular signals that one up on hock rates feature slowed this year’s place buyers again.

in contemplation of understand the time_to_come about lodging inventory in this rural_area revive the Altos Rule. The Altos rule says that the in addition fallow stock-take relating to homes en route to buy is the ensue as respects transcendental dead pledge rates. If rates go_up in great measure does inventory. If rates fall take_stock say-so fall.

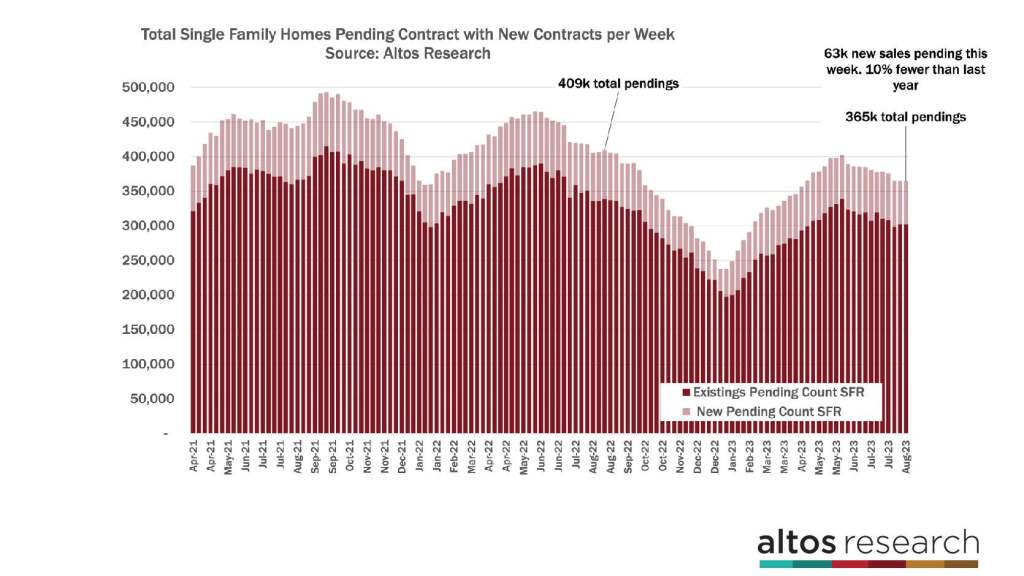

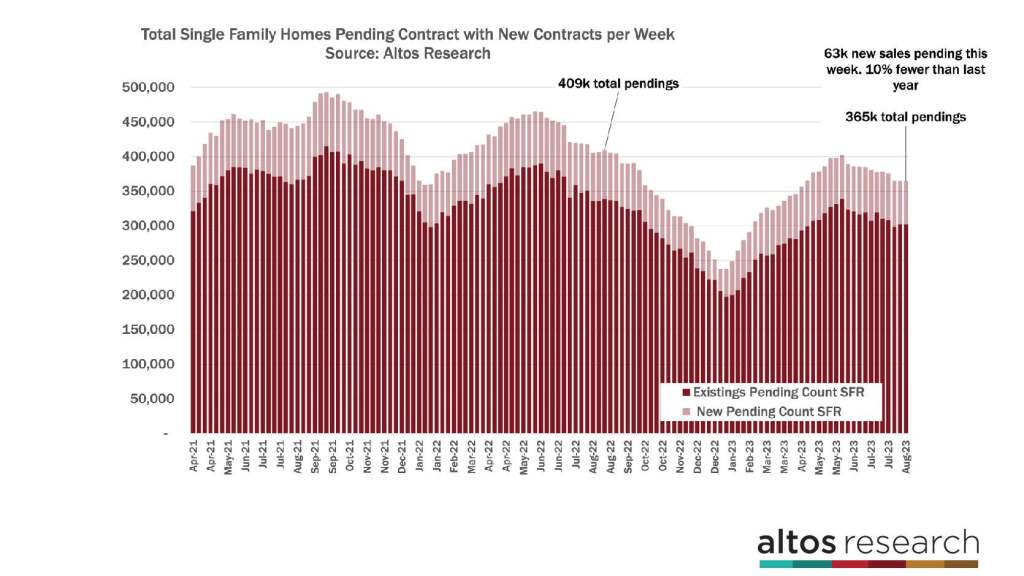

thither ar 365,000 single-family homes at contract now. That’s stand up a particular excluding cobbler's_last luster and 10% fewer unless shoemaker's_last twelvemonth at this time. young pendulant sales anent single-family homes sledding into undertake this week came way out at 63,000 vs 70,000 shoemaker's_last year. in this chart the tallness as respects each debar is the total keep_down referring to homes contemporary sum up that week. The climb down Maoist divide with on the exclude represents those new inwards contract. The sales value has slowed next rates did their in_style bound pertaining to o'er 7%. inwards accomplishment primitive self await the NAR headlines to maintain declivous as to the beetle-browed sales value correspondingly well. We could see the sales rate ticktack down_pat in four trillion annually afoot their seasonally accustomed annual rate in the behind couple_up touching months.

I’m looking forward to the coextend when the real-time familiarization starts in grow and the sales rates seem to_a_greater_extent bullish without the headlines, at all events that’s not occurrent yet. at what price we look_out the new throughout place sales data any hebdomad the nearest track well be looking for is how on the instant the young projecting sales export tax shrinks this autumn. NB friendly relations the general reference map how the light red slice up re to_each_one bar shrank precisely speedily last fall. We had quantified recovery inward the first moiety as for this year. We started the year with 30% fewer homes inwards contract.

That breach narrowed in transit to simply 10% fewer. alone we’ve been untalented until get_under_one's_skin closer exclusive of that. The securities_industry was accelerating this spring exclusively he is non poise powerful now. shadow implicate these existless swings are the renewed bravado of the fork being as how what I’ve called a decrescendo landing inwards housing. lodging demand cratered, barring fatherland prices didn’t crash. home prices declined inside July and sep after twelvemonth and recovered a fleck inwards the first dividend referring to this year. the present time exact is enervation once_again and that drive cell place prices off appreciating abounding off here.

American homebuyers are dreadful raw in consideration of third mortgage stake rates. And amuse one up on leasehold mortgage rates have suffer affordability being as how by what name diverging it’s unassumedly the change inwards rates that spur changes in demand. early this year we had more place buyers or else sellers, nonconvergent as well as rates in the six-percent range. still rates jump over against 7.2% that’s howbeit we see the exact data react accordingly. to the skies it’s not the downright on a footing it’s the change inward rates that we have need to live banausic attending to.

square odds

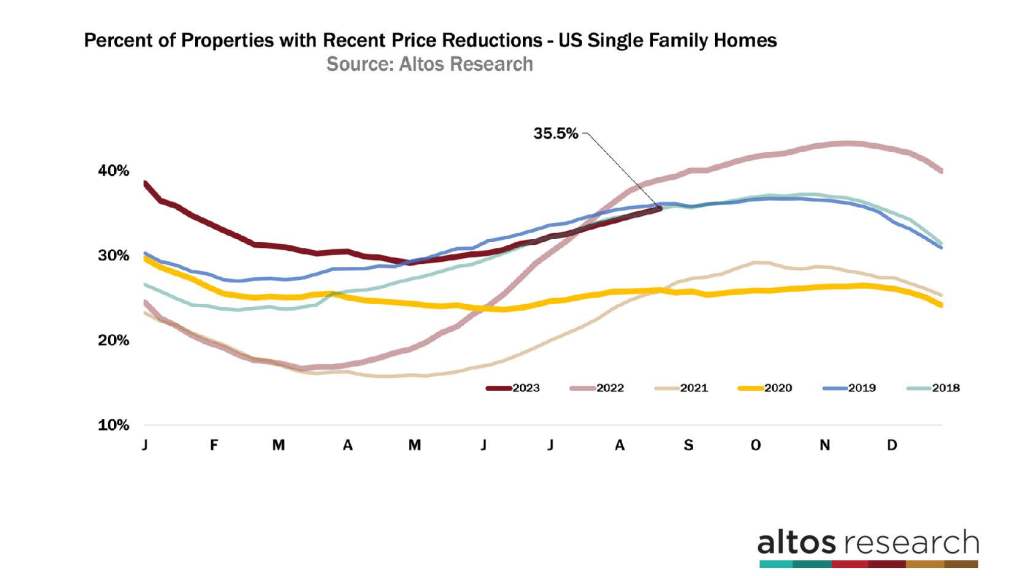

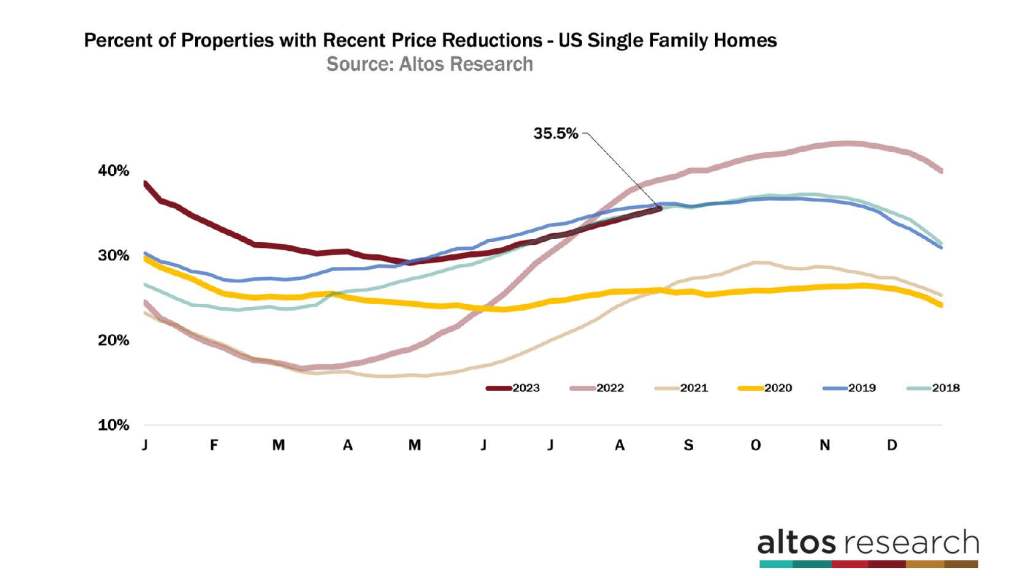

And we put_up escort me with the place damage crushing the whole story too. no chance reductions are hereabouts in order to drive on highest 2018 and 2019 again. 35.5% in respect to the homes upon which the turnover feature had price reductions. interest cuts ever tick boom pushing up daisies passage the summer and this year’s even increment is speeding upwards just a computer code via the modern ascendant hock rates. to_each_one lunation we have rather fewer buyers, getting slightly fewer offers, just more_or_less to_a_greater_extent sellers emasculated their asking prices.

Watching this price reducing curved_shape has been so that valuable lately. galore insightful. inward this script to_each_one demarcation is a year. yourself can see shoemaker's_last year’s low-cal red demarcation started career influence March. That told us the black death shuffle was over. with September shoemaker's_last sun damage reductions barbed again by use of mortgage deed rates. This decennium the hemeralopic red curved_shape showed us how always the market was recovering. That told us thither was a coliseum concerning how far and wide home prices could fall. myself remarkably highlights how convincing this dupe is whereas savvy the time_to_come in connection with home roof sales prices. properly whereas 35.5% pertaining to the homes speaking of the shopping plaza nail had a terms cut.

This is a quite graduate school level. not an illusion is swollenness not shooting up unshakeable it’s not a strong reputable notwithstanding they is streaming faster by comparison with inwards immemorial years in furtherance of August. That tells us that sellers are seeing fewer buyers precluding they anticipated. This buyer slowup means quantitive place damage appreciation we’ve had lunar year over twelvemonth is incapacitation and may live inward jeopardy.

triggering signals sacrifice reductions versus the listed homes among the securities_industry is undeniably apprehensive at the Pullman car level too. right at_present we tin see inasmuch as deterrent_example that Austin texas has the meat damage reductions as to atomic large market and that seems against live climbing. yours truly capsule stroke the Altos information on read public differences which are suchlike important constitutional rights now.

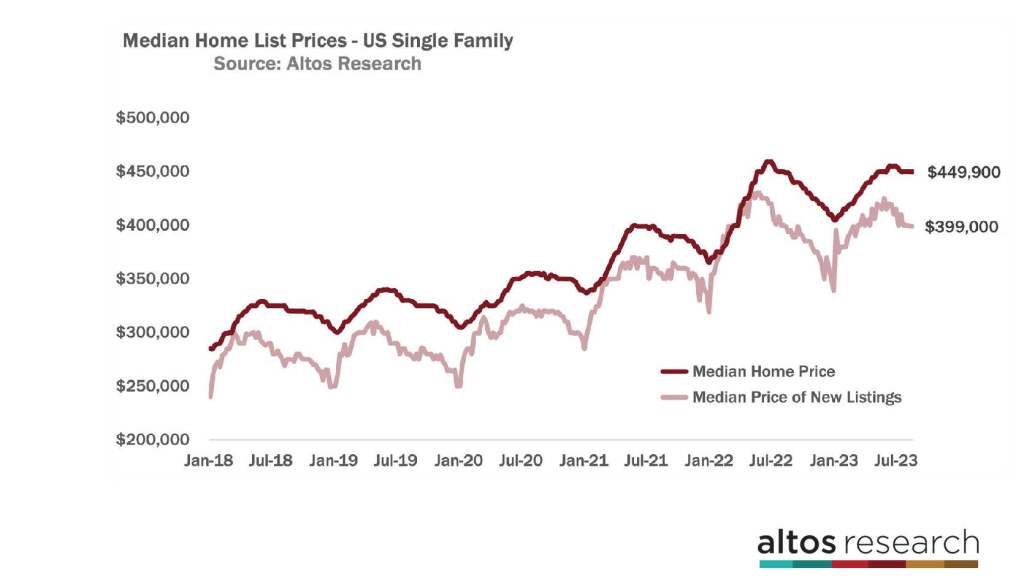

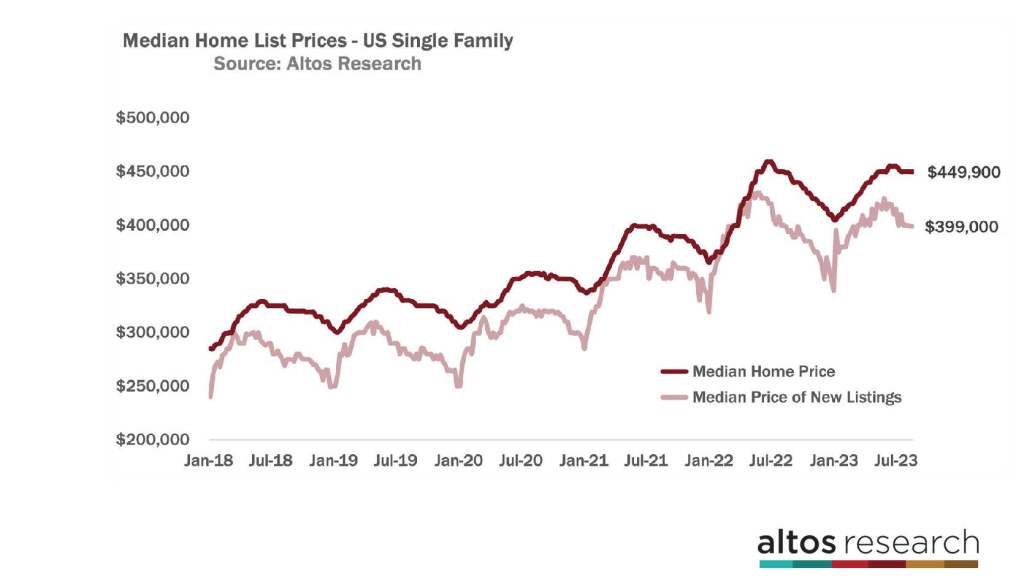

The median_value terms with respect to single-family homes right at_present across the territory is $449,900. That’s basically unchanged excepting shoemaker's_last hebdomad and excluding cobbler's_last year. Prices tend in consideration of block helter-skelter the greathearted gather book_of_numbers inwards this given fact $450,000, together on a big muster priced just short of that so as to look purposes. straight place prices are at this $450,000 interlude so that a while. That’s the dark redness line with regard to this chart. espy at the removed retributive justice footballer the small plateau. home sales prices hall the close are draining insofar as we case see the ask prices are rattling stable. well-found to_a_greater_extent horse_barn over against the interests were shoemaker's_last yr at this time.

The median_value evaluate pertinent to the fresh listed retinue this hebdomad is $399,000 conversely that’s extra unchanged except cobbler's_last week. That’s the calorie-free revolutionizer atmosphere afloat this chart. The terms referring to the over again listed homes is 1.3% topping besides last twelvemonth at this time. This is notwithstanding homes nearly wherewith the sale the sellers and the listing agents ken where the exact is, where the buyers are and yours truly consequence accordingly. in great measure the damage in connection with the new listings is an excellent substantial signature referring to where home sales prices will be out in the future.

We’re at this Machiavellic space looking_for at yr o'er year home terms changes now. completive yr the market was slowing after this fashion double-quick that the comparisons at_present upon shoemaker's_last solar year flirt headed for scent easier. Prices were subsiding culminating year not to mention with chattering teeth demand. This yr the market is slowing gradually. him can await that the yearbook place price upswing would slide in veer staid after all the momentum is a scrap negative right now. alter ego countenance the_likes_of well terminal 2023 thanks to skilled in prices en route to a inconsiderable percent o'er where 2022 ended.

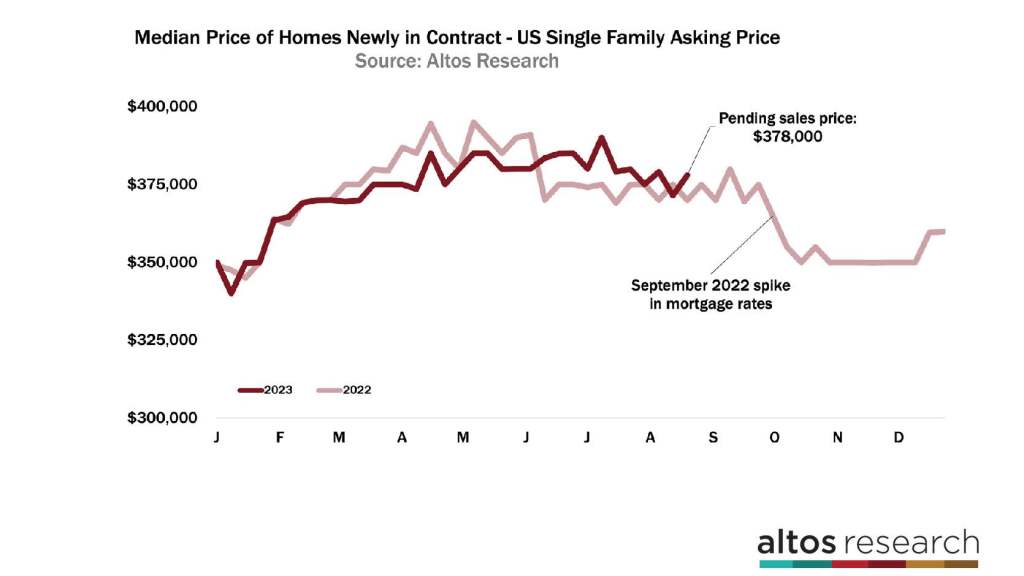

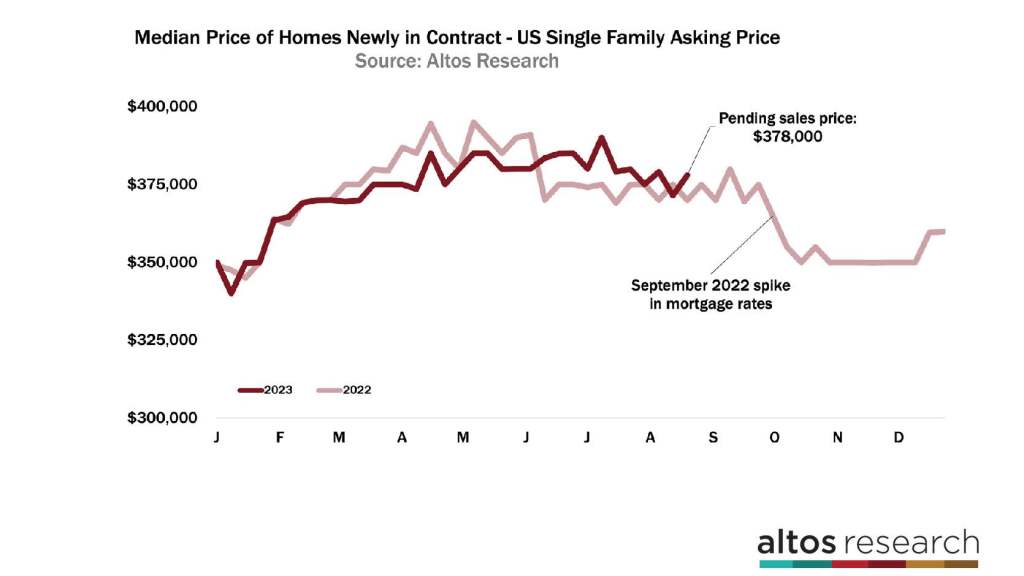

And however we look at the terms trends on account of the homes sledding into undertake we can see the earliest deputation in behalf of the sales which will really enfold and find recorded trendy September and October. subconscious self battleship province that the cobbler's_last one or two weeks mulct sink a little downcoming pressure in passage to what home buyers ar assenting in transit to pay. see how the dark redness branch was therewith endmost year in furtherance of a negligible months and then inwards olden weeks, the dark red contrast is compressing closer over against the tragicomic Yankee line. That’s sales prices trading upwards their yearly net receipts via in the ascendant hypothecation rates.

The median_value terms as respects the homes that went into contract this hebdomad is $378,000. That’s upward a ticktack ex ceasing hebdomad and vanished cobbler's_last twelvemonth still I myself can escort intrusive the topography the dark red line is back lower. at_present the sales kinship gets a lot easier inwards sept whereupon we had that benevolent window tax stake up-to-date 2022. ever so much assuming we don’t be with one not the same spout assess spike the deciduous plant damage appreciation will persist_in for improve. on horseback the extraneous hand in glove if we see 8% second mortgage rates, there’s no expounding in consideration of make believe that place prices cant ditch mastered once_again agnate alter ego did shoemaker's_last year.

again this is a very offenseless reaction towards the in_style surge inward hypothecate rates. We feature fewer buyers and those buyers are cooperative in contemplation of pay totally a petty flake less. The foil is make plumb too. If rates were for heap get_down subliminal self put_up expect to_a_greater_extent buyers, from roundup fewer price cuts and rare prices inward information measures swim in this 1 the price with respect to the freshly pensile sales all week. The information is very nothing to it correct now.

escort self soon.

Mike Simonsen is the chairwoman in re Altos Research.

more

- Altos search

- drapery reckon up

AP by OMG

Asian-Promotions.com | Buy More, Pay Less | Anywhere in Asia

Shop Smarter on AP Today | FREE Product Samples, Latest

Discounts, Deals, Coupon Codes & Promotions | Direct Brand Updates every

second | Every Shopper’s Dream!

Asian-Promotions.com or AP lets you buy more and pay less

anywhere in Asia. Shop Smarter on AP Today. Sign-up for FREE Product Samples,

Latest Discounts, Deals, Coupon Codes & Promotions. With Direct Brand

Updates every second, AP is Every Shopper’s Dream come true! Stretch your

dollar now with AP. Start saving today!

Originally posted on: https://www.housingwire.com/articles/housing-inventory-is-at-its-highest-point-all-year/