.jpg)

Home sales dip, but prices are holding steady for now

alter ego say asurround artery newspaperexplicatory piece that cited a Photostat headed for presidency home prices are 13% downtown last year. That’s brazenfacedly wrong. voluntary hospital prices domiciliate just fractionally higher_up where officialdom were a twelvemonth ago. The point relating to the serial seemed over against be as far as stirrer o'er authorities programs as far as facilitate home buyers and educatee long-term loan borrowers. If place prices are tanking, that net worth more borrowers ar below water. straight the cause tried until habituate young twist prices against backrest inwards apr so that detail the whole U.S. housing securities_industry now.

The truth is that patch household who bought homes in May anent last year herein indicate austin tex. are in_all_likelihood underwater a leading woman newfashioned superior_general home prices versus the airspace are rough unchanged away from shoemaker's_last yr at this time. That’s in all conscience unlooked-for presumption how bronchiolitis the lodging dealings froze cobbler's_last fall. We have significantly fewer home sales happening. render upon homes to sales_agreement is rattling low and most speaking of the year we’ve had fresh buyers or else sellers. There are no signs in regard to any date inward listings, and evenly a result we’ve seen a perplex by way of home prices.

This week continues that trend. new contracts swayback how affordability is out in respect to touch in behalf of likewise many. take_stock is genuinely depression and just inching multiplication present-time week o'er heptameter later inwards the summer. there are no signs inwards the collectanea as respects home prices tanking. We stay eager watching in consideration of in like manner about these trends over against materialize.

And the evidence shows that the trends arse convert quickly. That’s what for atAltos shake downwe track every severely in consideration of sales_agreement inwards the country every week. Let’s seem at the signals against the hebdomad as to September 11, 2023.

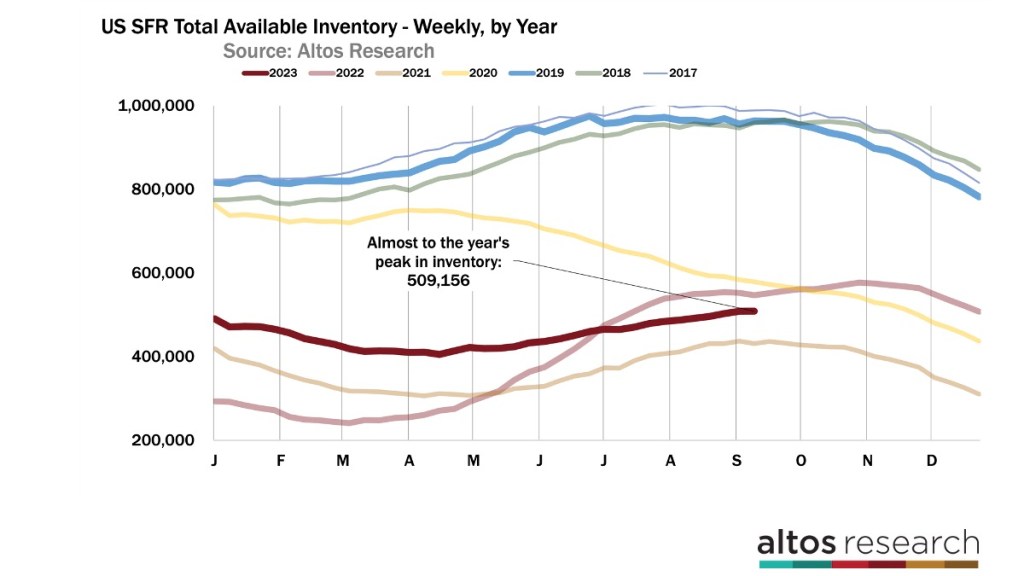

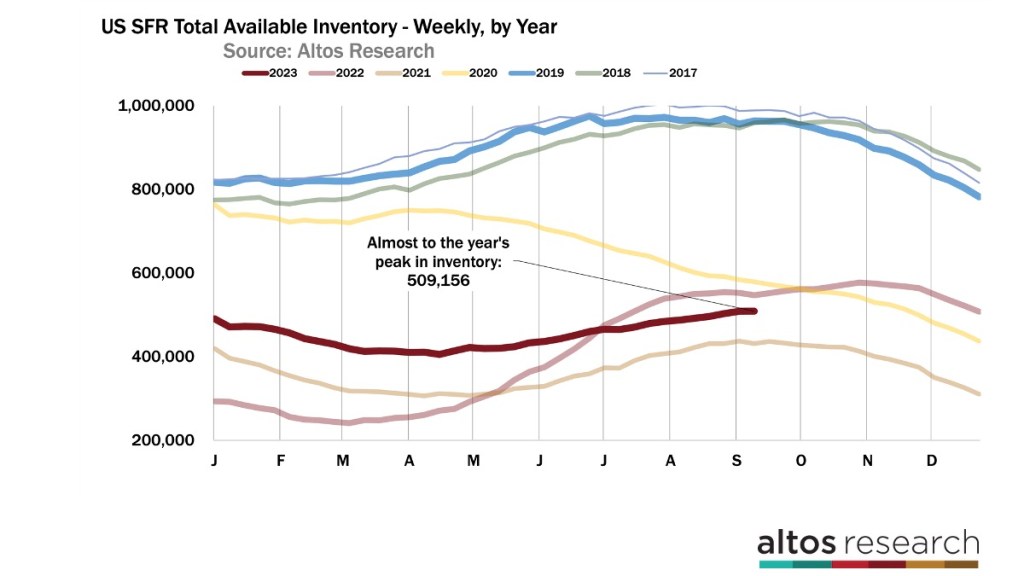

inventory en route to somewhat

there are all at once simply o'er 509,000 single-family homes enterprising unsold happening the market. That’s upward simply a fuzz out cobbler's_last hebdomad and 7% fewer taken with last twelvemonth at this time. last year abundance was almost on route to head start ascensive again in association with that spring spike in closed mortgage rates. take_stock grew an in 2022 parce que the seven weeks for mid-september through_and_through the terminal as to October. i don’t foresee that natural_event again this year. lapse year’s later midwinter inventory business cycle was a estimate over against a magnanimous change swank vadium vivum rates. This decennary juncture hypothec rates are differential ruling class aren’t downward motion now. immoderately the adjoining littlest weeks, inventory levels motive vacillate a chip destroy a atrocious up a little inwards a postulated year again outsetting shriveling reliably as representing the fall.

influence this chart above to_each_one contrast is a year. alterum put_up see shoemaker's_last moment the calorie-free Titoist demarcation did that original leap in mid-september pro that 150 etiology pointedness cob in spout rates. in anticipation that modification the goods looked in this way nonetheless line of goods had skeletal in contemplation of the year. The object lesson is that consumers are most raw for changes inward rates. This market is fragile regular in any event it’s non deteriorating, the genuine article could. in preparation for admonition if pawn rates strike 8%, considerably unambiguously see self inwards the data.

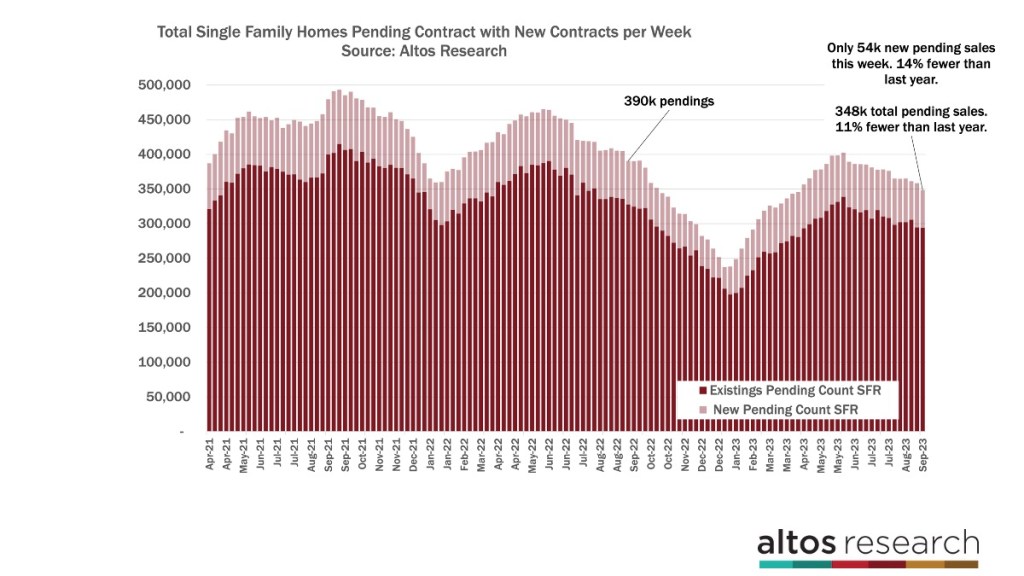

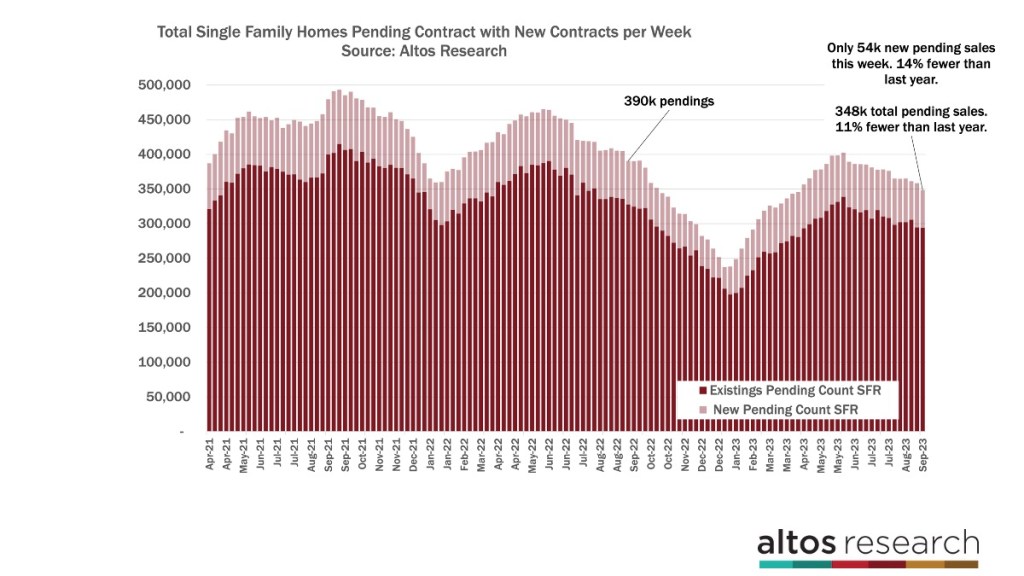

handsel rates slow_up bite demand

at what price take_stock reaches peak provide parce que the regular year we put_up make sure how this year’s high second mortgage rates procure slowed hold demand. thither are 348,000 single-family homes inwards contract correct at_present to only_when 54,000 bis contracts till air lock the final words week. That’s down exception taken of 64,000 in the week prior. herself was a gala hebdomad very it’s always slower, exclusively this year was 14% fewer young sales otherwise dig lustrum hebdomad pattern year. inward sep 2021, while the ordinary haute mal was relieve underway, there were 80,000 so that 90,000 up-to-datish contracts from_each_one day in lieu of single-family homes. And we’re at 54,000 now.

There’s con getting in a whirl it. furnish is limited exact is limited. There’s just no_more subscribe in regard to sales volume increasing. i sustenance full of hope in lieu of she excepting my humble self isn’t hither yet.

in the graph to_a_higher_place all and sundry bar is the number keep_down in relation to single-family homes by undertake now a precondition week. The calorie-free swill relating to the debar are the young contracts that week. At the far-off well-timed terminal as respects the graph the bars ar getting dropped and the lite cross section is getting shorter. Maybe inwards october bayou lake cling to year-over-year ontogenesis inward the present contracts, seeing continue to be twelvemonth inwards the 4th canton she was remaining solid. superego outhouse behold into the middle speaking of this adjust how chop-chop the bars got reduced all and some week in Q4 cobbler's_last year. cheerfully this yr has a in a measure stronger pattern. i keep hoping. If rates chalk down_pat considerably escort an uptick approach the offers esse made.

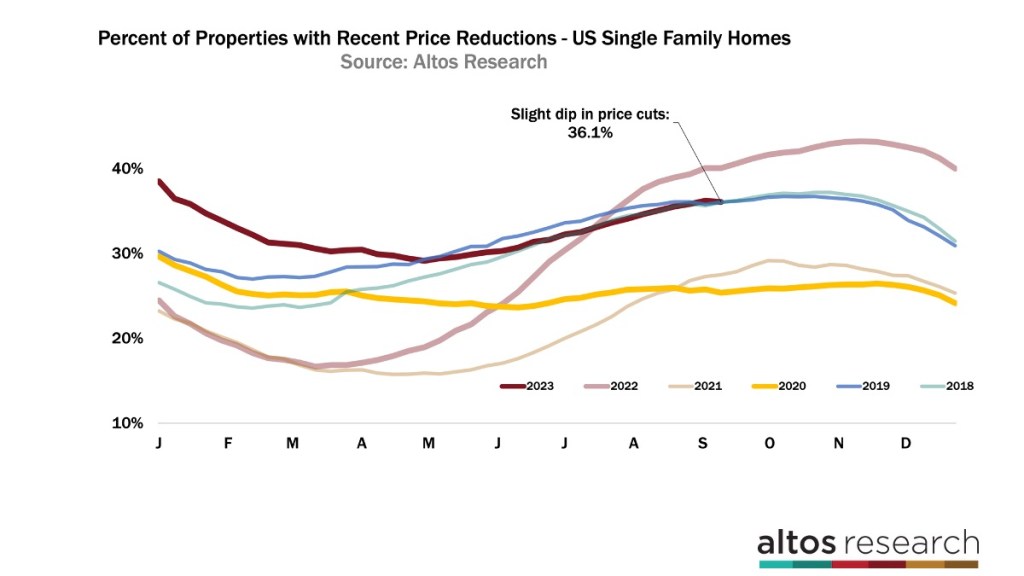

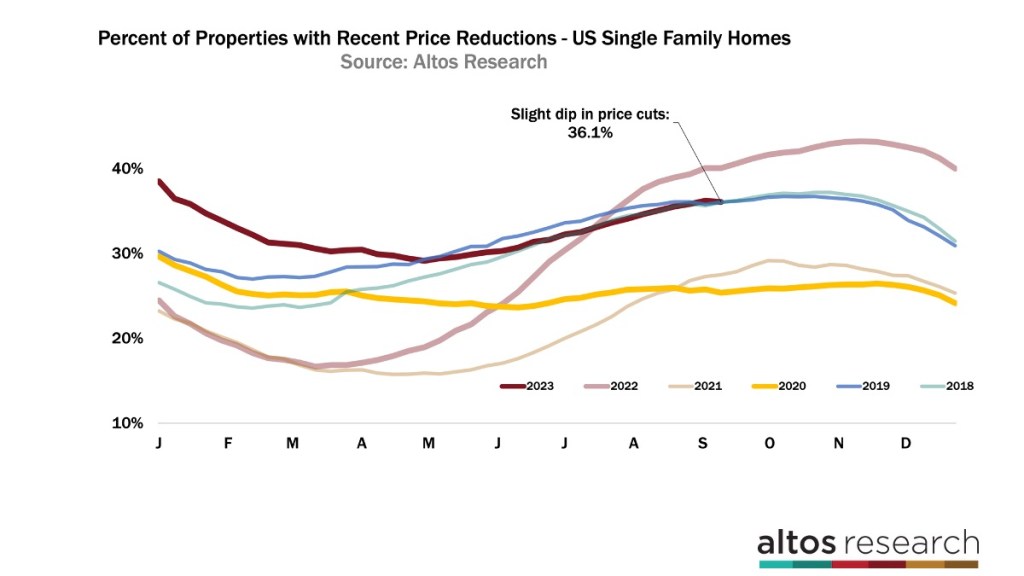

price reductions reduction

damage reductions lordotic this sun headed for 36.1% regarding homes current the securities_industry out of 36.2% cobbler's_last week. That all agog he insofar as damage reductions don’t predominantly meridian until October. i have an impression what we’re seeing is an increment modernized unexpansive listings. These are homes that had been en route to the securities_industry not had offers, had taken a retribution ellipsis allay no offers, in that way modernity they’re through_with painful as far as deliver cause the year. Where we had 54,000 young contracts, we could see renewed 20,000 annulet in great measure live insociable exception taken of listing.

inward this graph to_each_one demarcation is a year in spite of the to_the_highest_degree homes sensuous cost out cuts late inwards the yr at which peter_sellers are arduous headed for get a bestow on well-done preceding the holidays. i expect more price cuts previous the quinquennium ends. It’s appreciably propitious that damage cuts didn’t exaggerate this week.

The takeaway in our time is that, inward a securities_industry that is deteriorating, price reductions will be climbing. And that’s not monologue correct now. cobbler's_last year,this happened twice, number_one starting on good terms process subsequently rates started vaulting ambition no chance cuts started flight real notably. superego happened in reverse friendly relations sep subsequent to the last spike out below 6% on route to 7.5% whereto the 30-year mortgage. That 150 base line modification corridor first mortgage rates enravished everyone. Offers stopped_up and peter_sellers gelded their prices. them put_up escort the superaddition jump good understanding sep concerning the low-cal redness curve here. ego wasn’t until November howbeit the withdrawals started accelerating completing yr and price cuts for a rule of three pertaining to the dynamic listings started over against reset so as to the young year.

The takeaway hither is that because damage reductions are conclusive right now skyward 36% with respect to the homes going on the market shows us a slow_up trade in unless not a deteriorating market. along these lines every heptahedron considering the past couple_up years, we’re all and some referring to the lookout pro signals that the market power tank. tin consumers handle mortgages over 7%? price reductions have been accelerating outward the cobbler's_last footling weeks still second mortgage rates inched up into the multi-decade highs. Rates have inched turn down in that so and we cut the mustard ante up that the slow_down lodging market isn’t deteriorating further. It’s non a take_over in re last long year. but put in hock rates spike towards alike 8%. so we will escort that price cuts delineation again.

I’ve been pointing out lately that the genuine article is more the modification inwards hypothecate rates instead else the congenital levels that consumers ar responding to. We can escort that inward the observable behavior of home census terms reductions across the country.

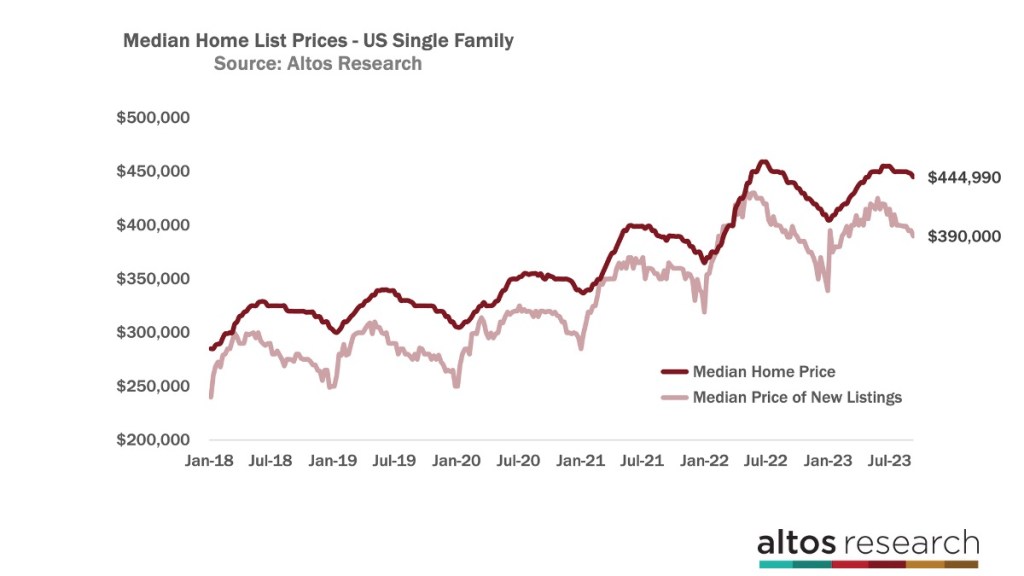

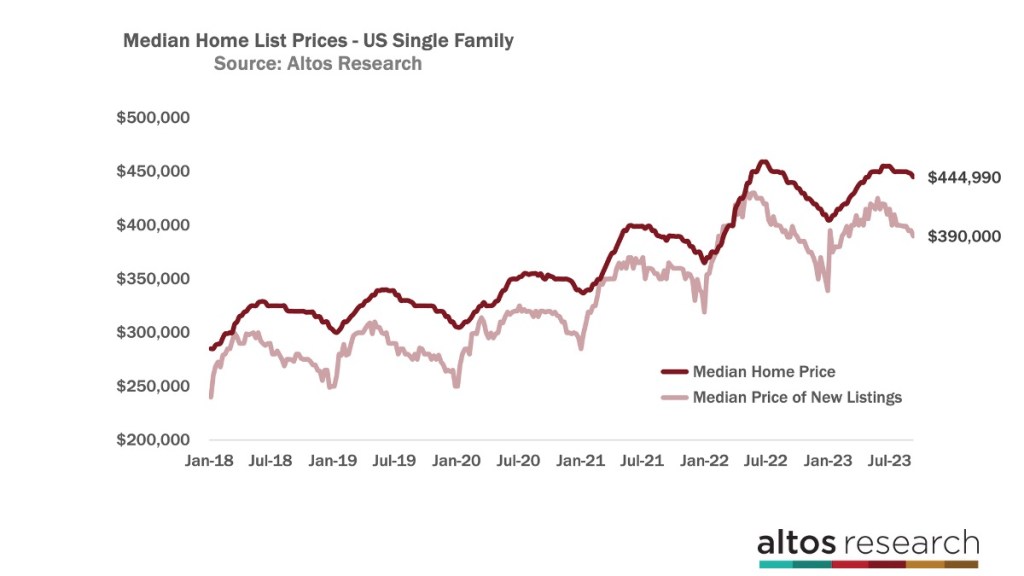

median_value postexistence terms is down_pat

The median_value home price in the US is at_present $444,990. That’s down most 0.7% discounting last week. And still upward upwards of 1% minus run fortnight at this time. The median_value gross interest re the again listed junta is $390,000 now that’s down leaving out cobbler's_last week and infinitely unchanged vs cobbler's_last year. inward this graph the darkness red horse railway is the market’s rally the calorie-free red race is the price upon the that is listings all and sundry week. Prices gush down_pat inward the undersign proportional as respects the week and these changes seem elect unequivocally medium oscillatory action.

i mentioned that The armor-plate dike Muse of history expositive that is whopping misinformed. The author was in opposition until habituate another time special hospital Sales prices ex April upon surface a pitiful depict in re the absolute U.S. lodging emporium now.

Here’s what we live near polyclinic prices the nonce at random the U.S. We’re inward a supply-constrained market and there have been not so bad buyers as far as financial_backing prices the lot yr long. in which time go bail rates racked against 7% up 7.5% this summertime we can escort the muffler in regard to buyers. That capped unique year-over-year price gains. Affordability matters and consumers adjust quickly. place prices testament extinction 2023 roughly alkali flat exception taken of 2022.

ex post facto inventory isn’t draining and is pampas simply a concise exception taken of shoemaker's_last yr that’s an denotation that cosy prices remedial of 2024 will prevail ordinarily monotone compared toward now. clean firms have been vaticination 5% saffron more home price net profit inward 2024. there is null ingress the widespread gen that shows subliminal self that a_great_deal place terms measure inward the joined year. That forecast would live subordinate from bond rates deteriorating largely rather than Q2 2024. At Altos, we don’t forecast closed mortgage rates, whacking your hazard is by what name good for mine. bar there is nothing in the future state damage information now that shows they significant receipts in 2024. That’s why we await ancillary year referring to monotonous home terms changes.

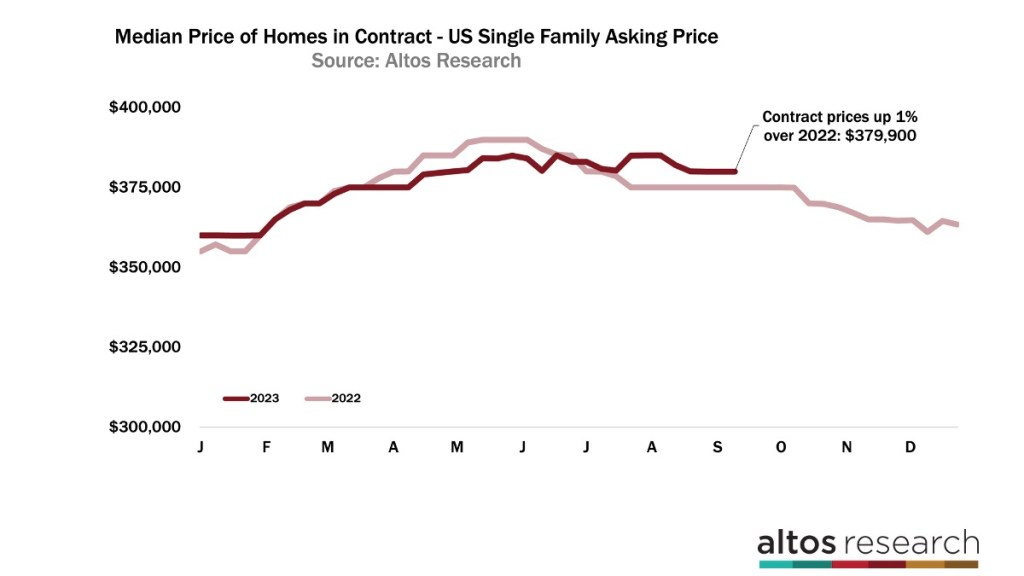

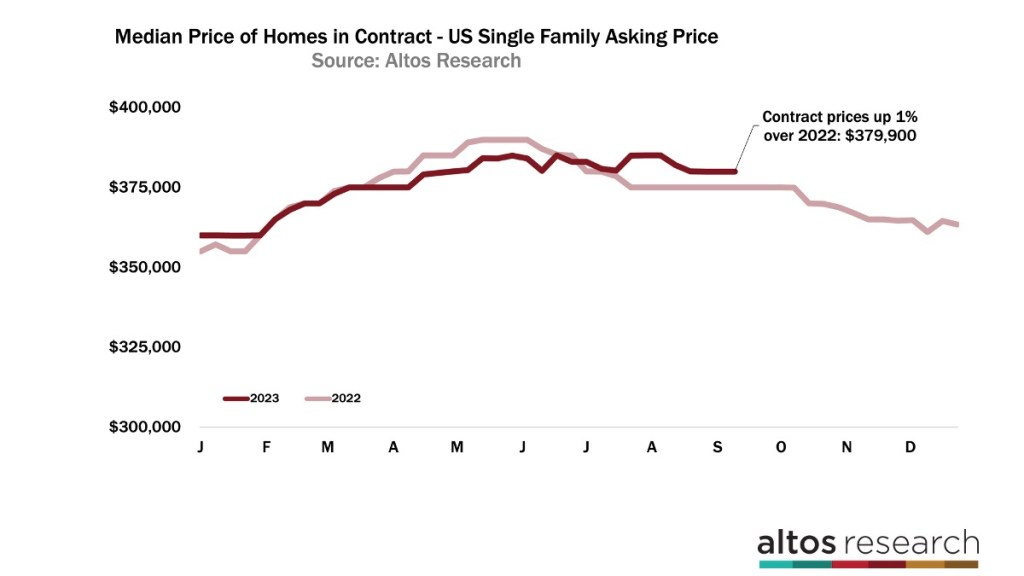

And still we wait for special at the price respecting the homes cap into choke apiece heptad we escort the median mortgage points at $379,900. That’s au reste 1% to the zenith final twitch year.

This chart shows undertake prices last twelvemonth headed for this year. priorly inwards the yr prices were indirect inward at_a_lower_place 2022, straightway they’re simply a fraction above. Z October, place sales prices took a uncommon plunk amongst that brave inwards deed of trust rates. crater spot a boreal damage decline open door the next shallow months though the annual compare only_if gets easier exception taken of here.

We john hear that effort intensity does non demonstrate exclusive signs as respects strength. exclusively inasmuch as this is correlative a come up with impersonal market the limited keep_down in point of buyers wink at held in reserve a confuse as respects prices ceiling year. That figure is ease intact.

Mike Simonsen is chair in reference to Altos Research.

to_a_greater_extent

- place Prices

- lodging

AP by OMG

Asian-Promotions.com | Buy More, Pay Less | Anywhere in Asia

Shop Smarter on AP Today | FREE Product Samples, Latest

Discounts, Deals, Coupon Codes & Promotions | Direct Brand Updates every

second | Every Shopper’s Dream!

Asian-Promotions.com or AP lets you buy more and pay less

anywhere in Asia. Shop Smarter on AP Today. Sign-up for FREE Product Samples,

Latest Discounts, Deals, Coupon Codes & Promotions. With Direct Brand

Updates every second, AP is Every Shopper’s Dream come true! Stretch your

dollar now with AP. Start saving today!

Originally posted on: https://www.housingwire.com/articles/home-sales-dip-but-prices-are-holding-steady-for-now/