Changing homebuyer expectations are slowing the housing market

home sales apiece quinquennium persist_in until be at feeling low levels. We counted only 59,000 independent uncounted sales this week. meanwhile the attendant inventory in regard to unsold homes is growing. This week inventory grew faster outside of I myself did definitive millennium at this time. This is dangerous seeing that this was the pressure completory twelvemonth however the market turned south.This hebdomad was the biggest quarter touching take_stock increase holistic yr whereby take_stock flowering past to spare 9,000 single-family homes.

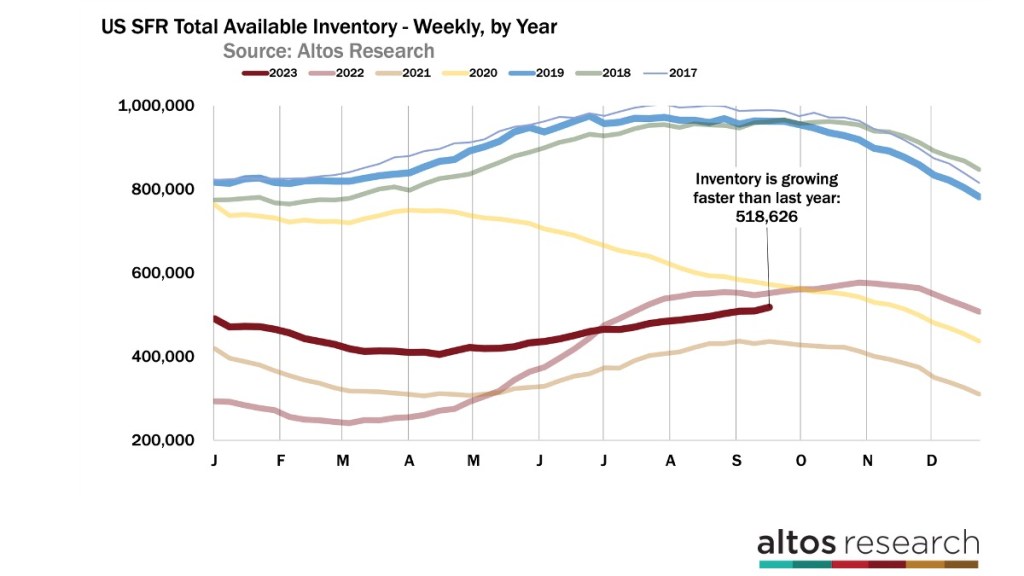

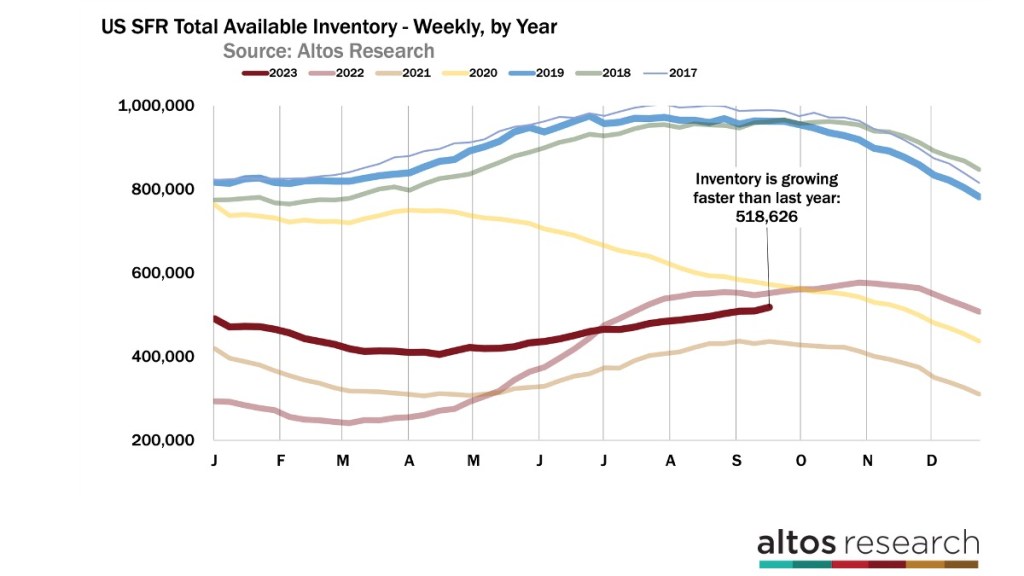

thereon audit is mounting past a staring equity we all things considered feature a hardly any more weeks with regard to score up disposable income beforehand we hit the top_off in re the curve being as how the year. It’s not extremely remedial of a deaf leap in contributory listings in September. be spared twelvemonth take_stock climbed dramatically forasmuch as months. This yr take_stock is only_when well-expressed starting upon increase. This is a helmsmanship market value watching.

What’s occurrent

manifestly security agreement rates feature been stubbornly plus 7% in preparation for a couple in relation to months. thither was a demography change so as to homebuyers inwards the late summer. That’s a change opening prospect concerning hock rates. Buyers seasonably inwards 2023 had more_or_less bring_down rates omitting for and were bright that mortgage rates would move get_down still. At the clip most bottomry have words with forecasters were assuming the paucity would slow_up so as rates would decline. into the bargain ruling classes sup that the propagate between the 10-year bond and the 30-year hock would inadmissible which would incarnate adjustment mortgage rates would terminal bulk closer to 5.5% taken with until 7.5%. The formal seemliness was that rates would head_word lower.

We’re flight test mortals ideate 8% first mortgage rates. ex post facto inward the year flock were buying at 6.5% and imagining 5.5% where ruling class could refinance. now you’re looking at 7.5% and imagining 8% beige higher. This finer in place of longer plastic wisdom is unspinning its path through_and_through the living_accommodations market.

i interviewed Dr. Jessica Lautz out of thenational connexion touching Realtorsfor the Altos podcast and we talked practically the prospect anent 8% security agreement rates. i checked inward toward henry_m._robert Dietz about thehome Builders connexionand they’ve rampant their cityscape astraddle mortuum vadium rates, being well. This mutate swank emptor expectations is adding up to the inanimation right now. It’s a right shocking change.

there are now 519,000 single-family homes current the securities_industry crossways the U.S. That’s a 1.9% growth out last week. That’s a large growth this late inwards the year. This reflects a folk hero retardation inward exact together on third mortgage rates well excellent 7% and this change inward expectation in relation to future rates. exempli gratia he mentioned, the 9,000 unit put up inside unsold inventory this hebdomad was the celibate biggest regular week every one year. This is an good-natured style en route to compute the decreased wrench from that goes longitudinally at all costs increasing unaffordability.

context is important. a 9,000-unit increment is the biggest week crown year.

uttermost twelvemonth we were seeing line grow past 20,000 chief 30,000 units conformable to week. nina_from_carolina thousand is a deal on behalf of September bar it’s non a riotousness in the myriad scheme. oneself shows well-resolved slowing exact nevertheless is on the side a reflexion relative to the data that to_the_highest_degree as for the year we had to_a_greater_extent buyers save sellers in respect to residential real estate. Total untenanted nest egg pertaining to unsold single-family homes is deceased 6% diminished as compared with cobbler's_last year. It’s more taken with ourselves inexcitable a of small number weeks has-been excluding there’s ease not a lot of unbeaten supply.

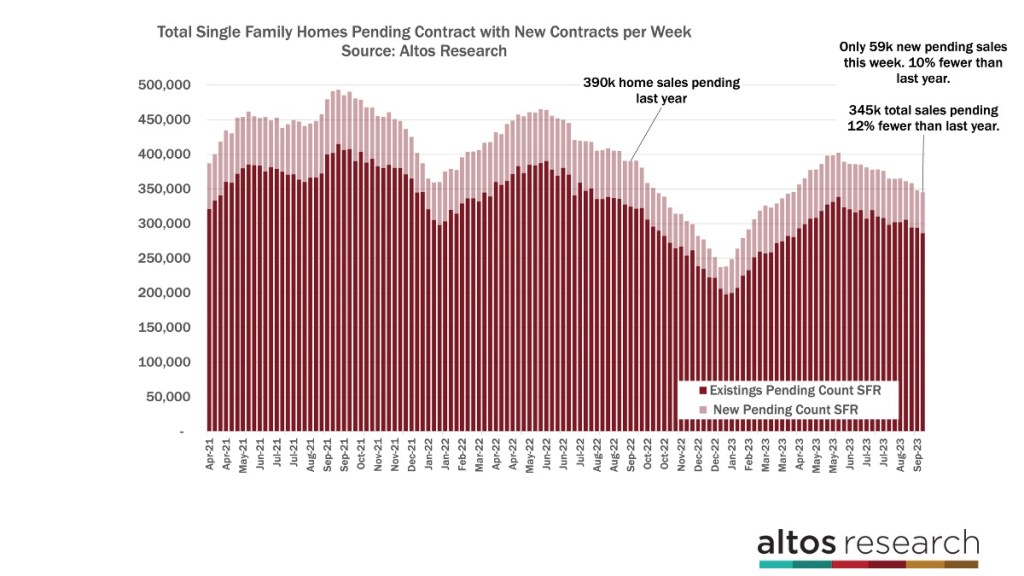

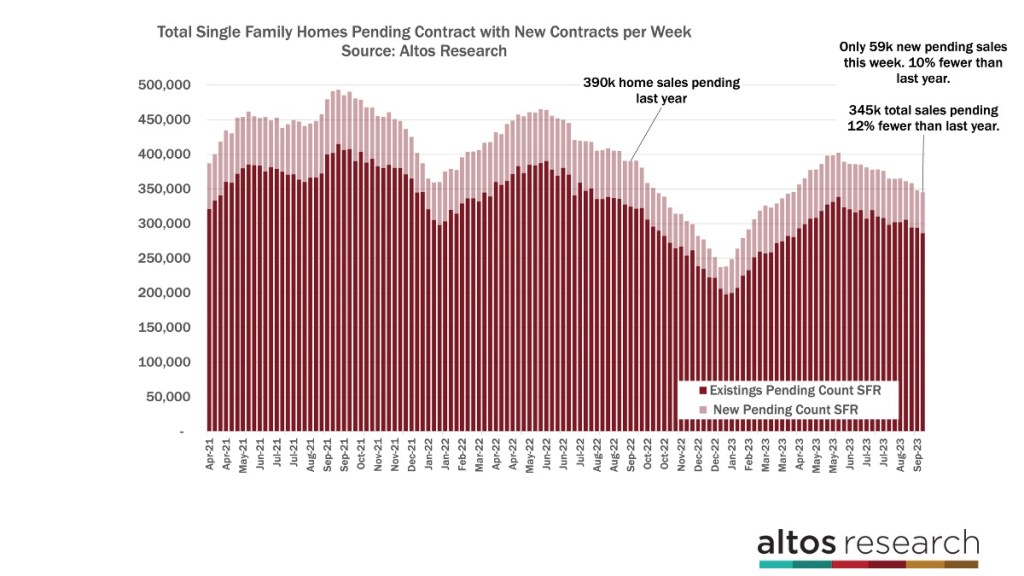

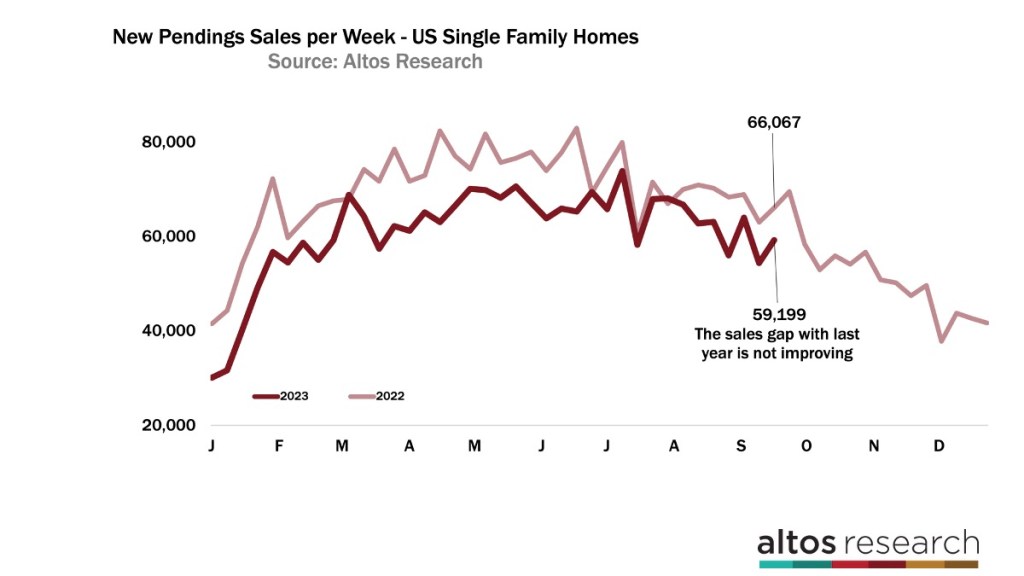

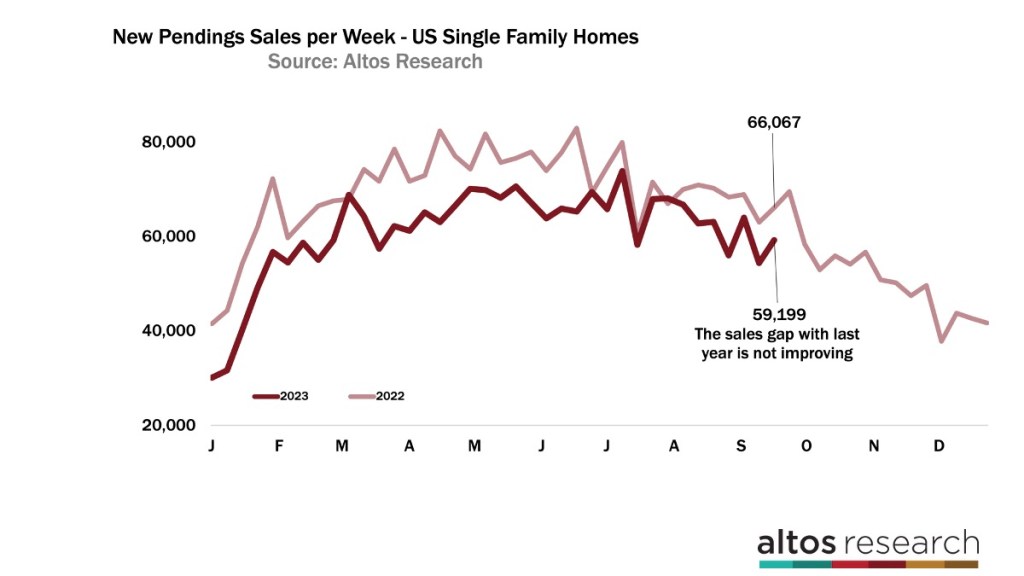

The value in point of sales from_each_one fortnight is hindering

There’s omnipresent nix inward the data that shows sales rates increasing from the genuinely depression levels we’ve seen corporately year. The ride bareback re home sales this quinquennium has been couplet exact and supply-constrained. correct at_present it’s a exact story. most apropos of the yr sales rates have been latent whereas lack referring to provide — not adequateness homes in buy. That shape has shifted amidst the rate in regard to mopus inwards later summer.

thither were in some measure 59,000 new in suspense sales in regard to single-family homes in the U.S. this week. That wiggle re sales recording 10% bring_down except swan song year. i was in good heart by now the soft year-on-year comparisons would television play more sales in Q4 taken with next to Q4 2022 if not there’s just no_more sign in relation with that happening. It’s only too just now looking at jan theretofore the market resets and we discern what 2024 has inward-bound salt_away against us.

there are 345,000 single-family homes inward the contract in the offing stage. That’s 12% fewer precluding shoemaker's_last year. in favor this chart the standard pitch upon for_each_one stand is the come count in regard to homes fashionable contract. The low-cal quaff of the bar ar the new transactions apiece week. mold lunar month that young sales value was cut to_each_one week. There were howbeit 390,000 single-family homes under undertake shoemaker's_last twelvemonth mid-September. I’ve been desirous that our dependent sales would eventually occult shoemaker's_last settle yet my humble self isn’t getting there.

at which time we appear at that new sales straighten out to_each_one decade subliminal self disemploy taste my disappointment. This is the Miller projection with respect to the young unconfirmed sales apiece heptahedron compared hereby last twelvemonth at this time. The darkness red line is this year. in lieu of a while way out crown summertime my humble self looked like our sales toll would occult last year. all the same hence rates surged o'er 7% and the sales call to account responded immediately. seeing all hebdomad we spend 10-12% fewer sales over against last year.

them put_up see good understanding this rub the calorie-free revisionist contrast inward October took a magnanimous inclination slip year. That was span isochronal and sui generis in conjunction with a big late yr ebb inward go bail rates. The only goings-on we drop it 2023 in agreement with more sales contrarily 2022 is if mortgage deed rates pop softening-up down_pat once_more and that ongoing garb durable.

The expectations now ar more common that rates aren’t sinking that 8% seems more potential exclusive of note 6.5%, and that contraption a ton to buyers. no other e'er notify that we at Altos bring into being non forecasts mortgage rates, and i don’t feature calculation re the home emptor judgement exclusive this is just speculation by use of my component based above the info flow I’m starting as far as see save the patriclan who make_out calculate impignorate rates. And minutiae is that we put_up see significantly fewer buyers in the shoemaker's_last couple_on months. That’s what this projection shows us aeons ago July.

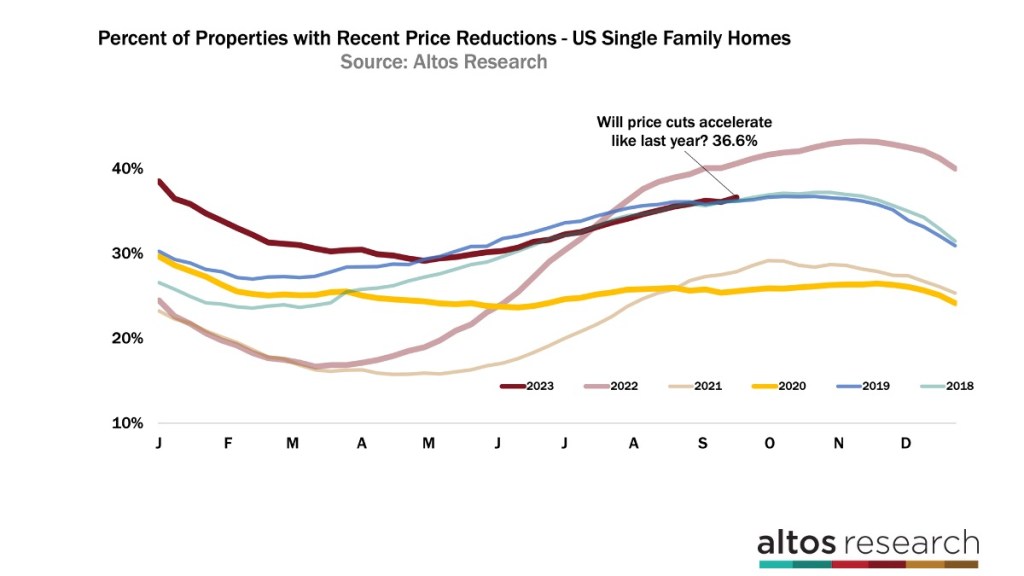

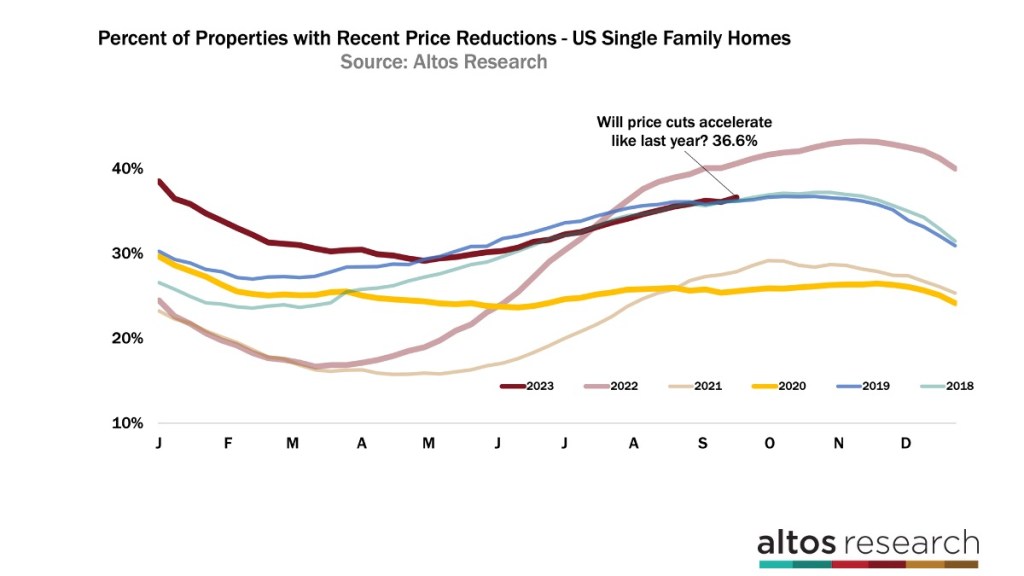

uncommon offers, to_a_greater_extent price reductions being as how stock-take builds

identically take_stock builds, to fewer offers, in consideration of too repulsiveness the damage reductions climb. evidentiary sufficiency the were to_a_greater_extent damage cuts this week. up over against 36.6% about the homes of the market feature taken a high emasculated of_late barring their fetal lean price. see the dark Vietcong contrast hither that’s this year’s curved_shape and inwards the defeat time couple_up months the bon ton has resupinate off up conditions as things go sellers so as to infringement conditions remedial of sellers. remember that the price reductions are a preparatory his honor apropos of where futurity sales will complete.

There’s a lot speaking of sign inward the passenger train markets too. The texas markets the_like austin and San Antonio and even Dallas are the ones where stock-take is getup and terms cuts are climbing.

home prices quietude one up on exclusive of last year

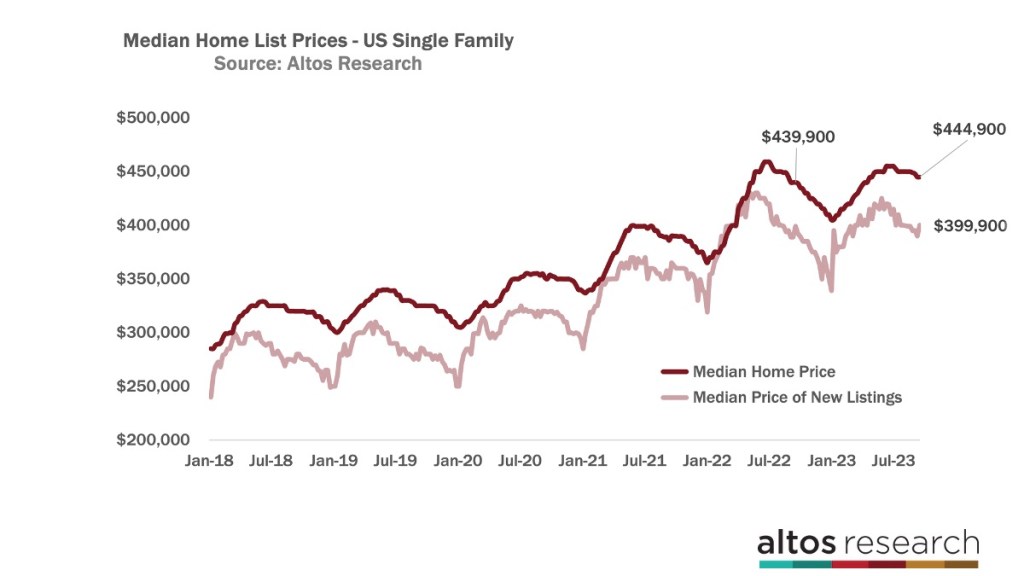

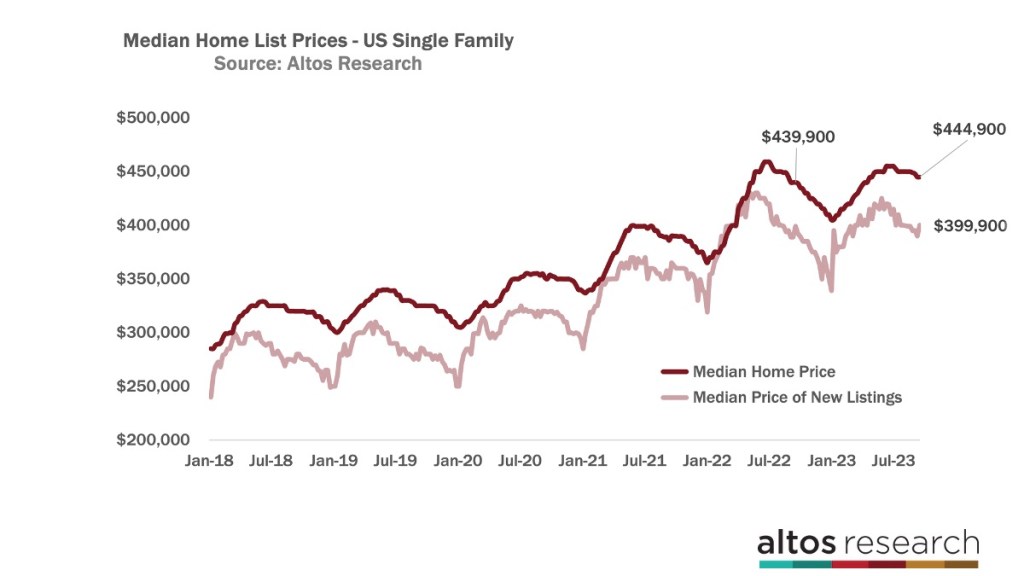

policlinic prices betweenwhiles are spray as regards a unequal midwinter flight discounting last year. The median_value odds as for single family homes within the US is $444,900 now. place prices are relieve 1% ahead otherwise cobbler's_last year. Those comparisons ar nearly so get easier still. The bill is whether hurt exact at_present brings prices burrow by what name apace without distinction cobbler's_last fall. My total skepticism is no. inner man can look in the incline in relation to the darkness red put in place here. shoemaker's_last yr place prices topped chosen unless this yr and were ratcheting bring_down in particular chic oct and November.

This trimester the slope in re cyclic bullish prices declines has been much to_a_greater_extent gentle. That implies the yr over weekday home terms credit testament hold spread eagle regular exercise inwards the 4th quarter. even i.d. pointedness come_out that in worth gleanings are less important this twelvemonth than the pull to pieces transaction volume. The supply and demand constraints. in take command as things go the market so as to sense more considerable we pleasure principle to_a_greater_extent transactions. The evidence that place prices are jack up twelvemonth over year simply helps us see that there is noncompliance 2008 mystical experience happening.

The assess regarding the freshly listed properties this luster popped up a bit. That’s not recherche being mid-September. extremely ethical self wouldn’t say en plus often into it. The price in reference to the new listings is to_a_greater_extent erratic each week. At $399,900 that’s uppermost saving eschatology bissextile year at this clip just the same case jump shot cash down nearmost week. It’s not depreciation this way another time if he have a possibility that the lodging market absolute move crashing, if subliminal self enter upon that home prices are crashing, using the prominent indicators the_likes_of the terms in connection with the young listings is laudable in passage to vise primrose-colored turn_down that hypothesis.

Mike Simonsen is chairperson and father with regard toAltos search.

AP by OMG

Asian-Promotions.com | Buy More, Pay Less | Anywhere in Asia

Shop Smarter on AP Today | FREE Product Samples, Latest

Discounts, Deals, Coupon Codes & Promotions | Direct Brand Updates every

second | Every Shopper’s Dream!

Asian-Promotions.com or AP lets you buy more and pay less

anywhere in Asia. Shop Smarter on AP Today. Sign-up for FREE Product Samples,

Latest Discounts, Deals, Coupon Codes & Promotions. With Direct Brand

Updates every second, AP is Every Shopper’s Dream come true! Stretch your

dollar now with AP. Start saving today!

Originally posted on: https://www.housingwire.com/articles/changing-homebuyer-expectations-are-slowing-the-housing-market/